Justin Pope

AI is a game changer that could help one of the world’s best companies build immense wealth for investors over the coming years.

After a couple of years of making headlines in the stock market, artificial intelligence (AI) is starting to creep further into real-world applications. AI tools include large language models, virtual agents, robot workers, self-driving vehicles, and more.

If you’re a Gen Z investor — born 1996-2012 — it’s a tremendous opportunity to build wealth if you can find the right companies to seize AI’s potential over the coming decades. Note that if you’re under 18, you’ll likely need a parent to set up a brokerage account for you so you can own stocks.

Fortunately, you don’t need to overcomplicate things when looking for an AI stock to get started with. Amazon (AMZN) is known for its e-commerce and cloud computing businesses, but investors may underestimate the extent to which AI could benefit the company over the coming years.

Here is why it’s arguably the best AI stock that Gen Z investors — who have decades to retirement — can buy and hold.

Cloud leadership makes Amazon crucial

Amazon is already one of the top AI stocks due to its world-leading cloud computing platform, Amazon Web Services (AWS). It is estimated that AWS owns about 30% of the global market. It is an essential business unit for Amazon because it’s the company’s largest profit center. Companies are increasingly operating their IT through the cloud instead of with on-premises servers, so it’s going to be the medium through which AI applications will primarily work.

In other words, AI applications are going to boost cloud usage.

Analysts at Goldman Sachs believe AI tailwinds will drive cloud revenue to $2 trillion by 2030. If Amazon had 30% of that, that would be $600 billion. AWS revenue was $107 billion in 2024. If that forecast is remotely accurate over the next five years and beyond, AWS should see significant growth. Since its cloud platform is so profitable, Amazon’s earnings growth would also enjoy a massive tailwind.

AI could boost margins in the retail business

Amazon is more known among consumers for its dominant e-commerce business, which has an estimated 40% share of online shopping in the United States. Retail juggernaut Walmart is in second place at only 10.5%. Amazon uses its massive size and supply chain to beat competitors on product price, selection, and delivery speed.

However, it’s not cheap to do so. The company invested a ton of money into its e-commerce supply chain during the early days of the pandemic (2020-2021), and its employee count has exploded as a result:

Amazon thrives on selling goods at thin margins, but AI could eventually become the key to boosting its retail segment’s margins. There are numerous opportunities for AI to displace human workers and lower costs over the coming decades, including:

- Self-driving vehicles and delivery drones.

- Automated order fulfillment in distribution centers.

- Virtual customer service and shopping agents.

The company has already begun experimenting with and implementing AI and automation across all three areas. Amazon should continue to invest in these because e-commerce accounts for only about 16% of total retail spending in the U.S. E-commerce has been growing for nearly three decades, and it could easily continue for decades to come.

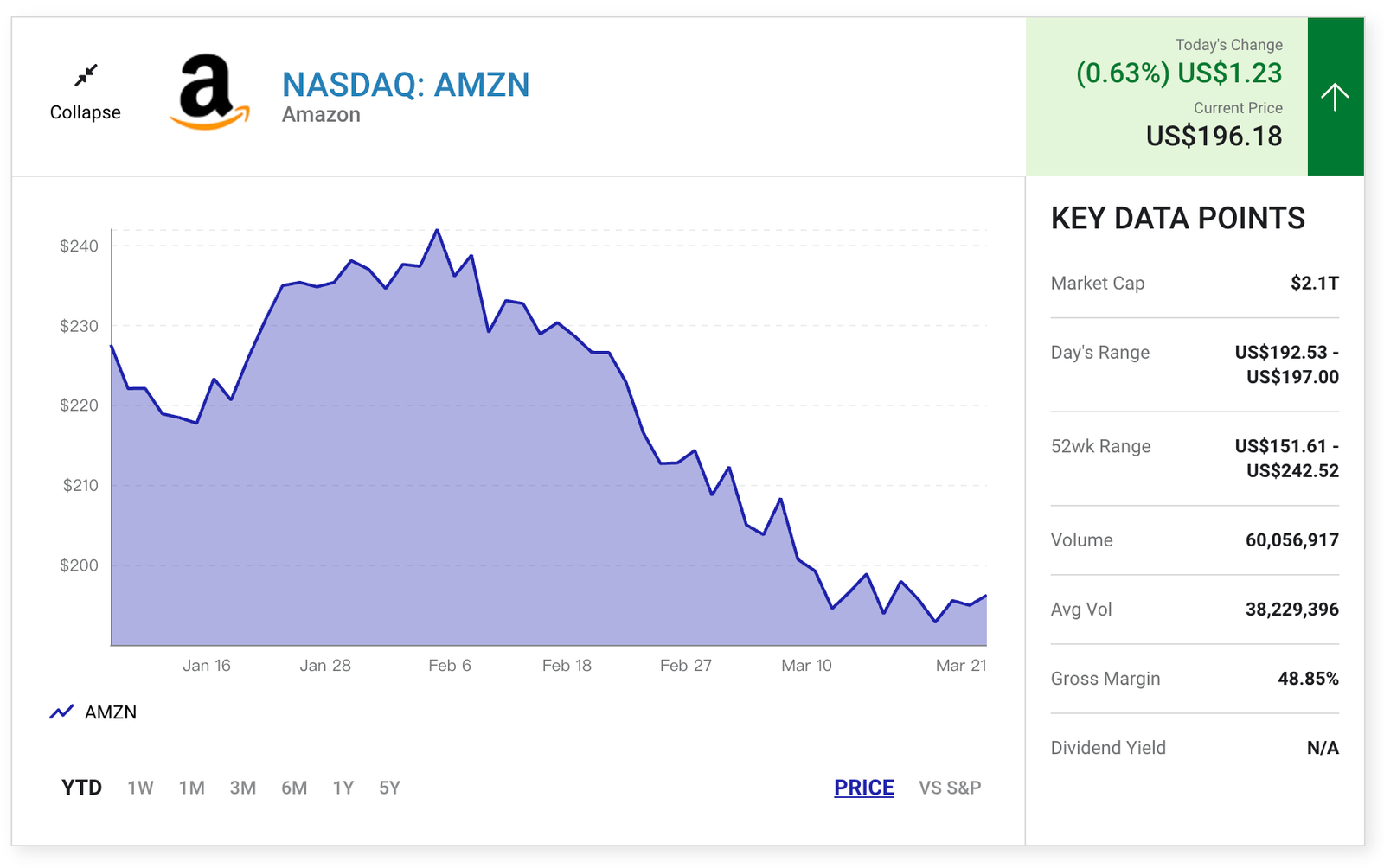

Recent volatility in the stock market has soured Amazon’s price momentum. Currently, shares are about 20% off their high. However, the company’s earnings reflect a thriving business, which should continue. Analysts estimate that Amazon will grow its earnings by an average of 21% over the long term. Meanwhile, the stock trades at a price-to-earnings ratio of 34 today.

I like using the price/earnings-to-growth ratio (PEG), which weighs a stock’s valuation versus its anticipated growth. I generally buy high-quality stocks at PEG ratios up to 2.0 to 2.5; Amazon’s PEG ratio (1.7) is comfortably below that threshold.

That makes the stock a solid short-term buy and a no-brainer for investors who plan to buy and hold, letting Amazon’s growth opportunities in cloud computing, e-commerce, and AI translate to outsize investment returns over the decades ahead.

Justin Pope has no position in any of the stocks mentioned. The Services and the Content are provided to you solely for your general informational purposes, and should not be considered as legal, tax, accounting, financial or investment advice.You are solely responsible for determining whether any investment is suitable for you, considering your investment objectives, risk tolerance and personal financial situation. It is also your responsibility to evaluate the merits and risks of using the information provided on this site before making any decisions.