By Charles-Henry Monchau

This article takes a closer look at five of the most notorious financial bubbles in history. As capital pours into the technology sector, one question remains: Could AI be the next bubble?

The so-called “Magnificent 7” started the year on a historically low note, with all members posting double-digit losses. The S&P 500 recorded its weakest quarterly performance since the third quarter of 2022. However, the sell-off was concentrated, with 7 out of 11 S&P 500 sectors still in the positive year-to-date, indicating this was primarily an AI and technology correction.

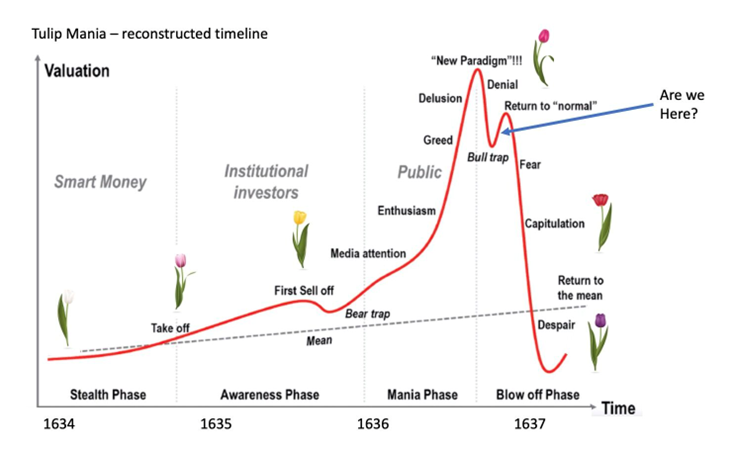

It often begins similarly: a spark of excitement, a new opportunity, the promise of untold riches. Prices begin to rise. Skeptics are brushed aside. Fortunes are made—until they vanish. Every bubble eventually bursts, and when it does, the fallout can spread through entire economies. Known as an economic or asset bubble, a financial bubble occurs when the price of an asset—be it stocks, real estate, or even tulip bulbs—soars far above its intrinsic value.

- The Tulipmania Bubble (Netherlands, 1637)

Regarded as the first recorded financial bubble, Tulipmania swept through the Dutch Republic in the early 17th century during a period of remarkable prosperity known as the Dutch Golden Age. Tulips, introduced from the Ottoman Empire, quickly became luxury items, especially rare varieties known as “broken tulips,” which displayed unique colors and patterns due to a mosaic virus.

By the 1630s, demand surged, leading to the emergence of a futures market where bulbs were bought and sold before they were even grown. Prices skyrocketed to absurd levels, with some bulbs selling for more than a house in Amsterdam.

Several factors fueled this mania. During the early 17th century, the Dutch Republic experienced significant economic growth due to trade, making it one of the wealthiest nations with a GDP per capita estimated at 1,200 guilders. This newfound wealth led many to borrow or divert funds into tulip speculation.

People began buying bulbs not to plant, but to resell at a profit. Even the middle class entered the market, fearing they would miss out.

However, in February 1637, the illusion shattered. An auction failed to attract buyers, triggering a collapse in confidence. Within days, prices plummeted, with many bulbs losing over 90% of their value.

- The South Sea Bubble (United Kingdom, 1720)

Sir Isaac Newton, one of the Enlightenment’s greatest minds, reportedly lost £20,000 (equivalent to about $3 million today) in the “South Sea Bubble,” often considered the world’s first Ponzi scheme. Founded in 1711, the South Sea Company was a joint public-private venture established through an Act of Parliament.

Its goal was to develop profitable trade with Spanish colonies in South America. The British government granted the company exclusive trading rights in the region, a monopoly that promised immense profits.

Inspired by the success of the East India Company, investors rushed to buy shares. The hype reached such heights that even King George I took on the role of company governor in 1718. In 1720, Parliament allowed the company to assume control of the national debt, valued at £32 million, at a heavily discounted price.

The scheme relied on funding interest payments on the debt with capital raised from selling increasingly expensive shares. Consequently, the stock price soared from £125 in January to over £1,000 by August.

Unfortunately, the anticipated trade routes and riches from the South Seas (present-day South America) never materialized. The company’s success was based almost entirely on speculation, lacking the underlying revenues to support its inflated valuation. By September 1720, confidence crumbled, and the bubble burst, with shares collapsing to £124 by year-end, triggering a financial panic across Britain.

- Japan’s Real Estate and Equity Market Bubble (Japan, 1991)

Japan’s asset bubble of the 1980s exemplifies how aggressive monetary easing can unintentionally create financial instability. In the early 1980s, a sharp appreciation of the yen—over 50%—plunged Japan into recession by 1986. In response, the government implemented fiscal expansion and loose monetary policy to stimulate the economy.

These measures proved too effective. Low interest rates and abundant liquidity ignited a speculative frenzy, particularly in equities and real estate. Between 1985 and 1989, the Nikkei stock index and urban land prices both more than tripled.

Unfortunately, this growth was unsustainable. In 1991, asset prices collapsed, leaving banks with mountains of bad debt and plunging the country into a prolonged period of deflation, weak consumer demand, and sluggish growth. This era came to be known as Japan’s “Lost Decade.”

- The Dot-com Bubble (US, 1997-2001)

Fueled by rapid growth in the Internet and a widespread belief in a “new economy,” investors in the late 1990s poured money into technology and internet-based startups. The Dot-com bubble traces its roots back to the invention of the World Wide Web in 1989 and the explosive rise in internet usage throughout the 1990s.

Investors eagerly funneled capital into tech ventures, driven by the belief that the internet would revolutionize the economy. The Nasdaq Composite Index surged over 580% from 1990 to its peak in March 2000. However, many tech companies were grossly overvalued, and most startups struggled to prove they could generate sustainable cash flow.

By 2000, confidence began to wane, leading to a brutal correction. The Nasdaq lost nearly 80% of its value by October 2002, causing several technology and communications companies—such as Pets.com, Webvan, Boo.com, WorldCom, and NorthPoint Communications—to go bankrupt.

Yet, some internet-based companies like Amazon (NASDAQ:AMZN), eBay (NASDAQ:EBAY), Microsoft (NASDAQ:MSFT), and Qualcomm (NASDAQ:QCOM) survived and went on to shape the internet age that followed.

- The US Housing Bubble (US, 2007-2009)

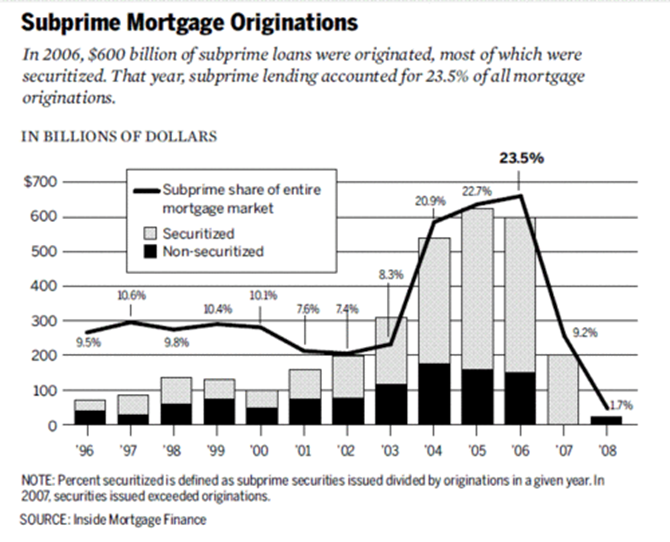

In the aftermath of the dot-com bubble, capital shifted towards what appeared to be a more stable asset class: real estate. At the same time, the US Federal Reserve cut interest rates to prevent a mild recession and mitigate uncertainty following the September 11 attacks. This low-rate environment, combined with government policies promoting homeownership, set the stage for one of the most impactful bubbles in modern history.

As borrowing costs dropped, housing demand surged. Banks, eager to increase mortgage issuance, began relaxing lending standards. Subprime loans—mortgages issued to borrowers with poor credit histories—became more common. These high-risk mortgages were bundled into complex financial products like mortgage-backed securities (MBS) and collateralized debt obligations (CDOs), which were sold to institutional investors worldwide.

As long as home prices kept rising, the perceived risks seemed manageable. Indeed, from 2000 to 2007, the median US home price increased by over 55%.

However, when borrowers began defaulting, especially on subprime loans, the entire system unraveled. Banks holding toxic mortgage assets faced catastrophic losses, credit markets froze, and the housing crash triggered the 2008 global financial crisis.

- AI Bubble (World, 2025?)

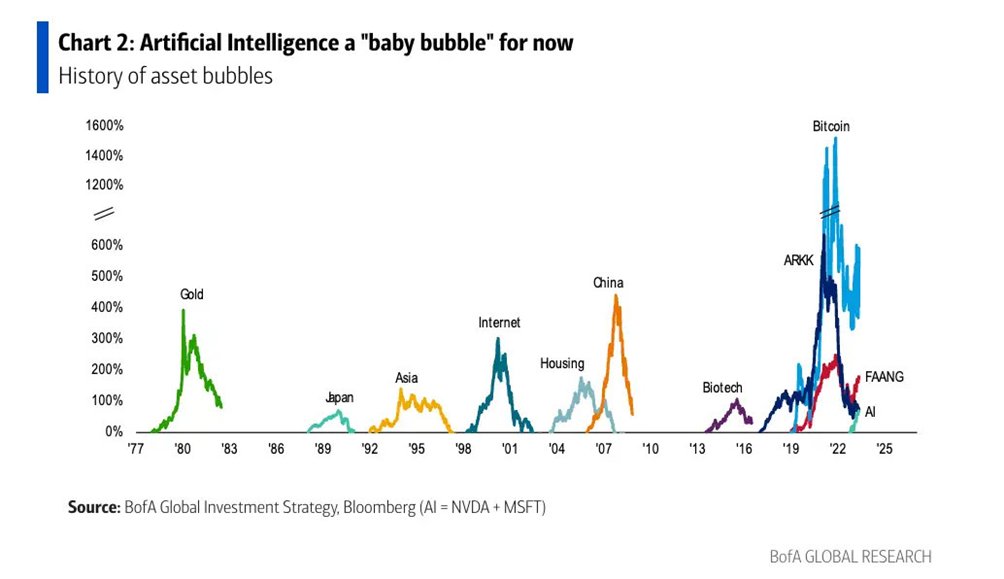

In the first quarter of this year, tech stocks faced pressure from macroeconomic uncertainty and tariff tensions. The Nasdaq-100 dropped by 8.1%, while the S&P 500 fell by 4.3%, marking its weakest quarterly performance since Q3 2022. The so-called “Magnificent 7” also had a poor start, with all members posting double-digit losses.

However, the sell-off was largely concentrated; seven out of eleven S&P 500 sectors remained positive year-to-date, indicating this was primarily a correction focused on technology and AI-related stocks.

Tech giants are investing billions to scale their AI capabilities, pouring funds into data center infrastructure and research and development. For example, the Stargate Project, initiated under President Trump, aims to position the US as a global leader in AI infrastructure, with around $500 billion earmarked over four years.

In Europe, the EU has launched InvestAI, a €200 billion initiative for the AI sector, which includes €20 billion dedicated to AI gigafactories. The UAE has partnered with France to invest between €30 billion and €50 billion in an AI campus and a 1-gigawatt data center.

Despite this momentum, recent events have shaken investor confidence. The DeepSeek controversy in January and the underwhelming IPO of CoreWeave, despite strong backing from Nvidia (NASDAQ:NVDA), have raised doubts about the sustainability of Big Tech’s valuations. Wall Street is increasingly questioning the narrative of “US tech exceptionalism.”

Even industry insiders are sounding alarms. Alibaba (NYSE:BABA) Chairman Joe Tsai recently warned that “the beginning of some kind of bubble” is forming around data center construction. Microsoft has reportedly canceled several data center projects.

Adding to the uncertainty, macroeconomic headwinds are mounting. A softening labor market, persistent inflation, and cautious consumer sentiment are eroding the growth buffer that followed 2020. Economists now warn of increasing recession risks, with JPMorgan raising its probability of a US recession from 40% to 60%.

The current hype surrounding AI, particularly in today’s unstable macroeconomic and geopolitical climate, evokes memories of past speculative bubbles. While the dot-com bubble’s excesses were evident, network technologies eventually reshaped the global economy. The crash occurred partly because widespread adoption of the internet took longer than expected. Similarly, advancements in artificial intelligence may take time but should not be dismissed due to uncertainty about their timing.

Conclusion

The painful lessons of past financial bubbles have made one thing clear: bubbles are driven more by human emotion than by innovation. Even the brightest minds, including figures like Isaac Newton, have fallen victim to the cycles of greed and fear. Despite these risks, investing in equity markets has become almost essential for those seeking returns that outpace inflation. The challenge lies in maintaining focus on fundamentals.

The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of Censational Market.