The American Dream has become increasingly out of reach, with home affordability hitting historic lows and the traditional middle-class lifestyle slipping away from most people.

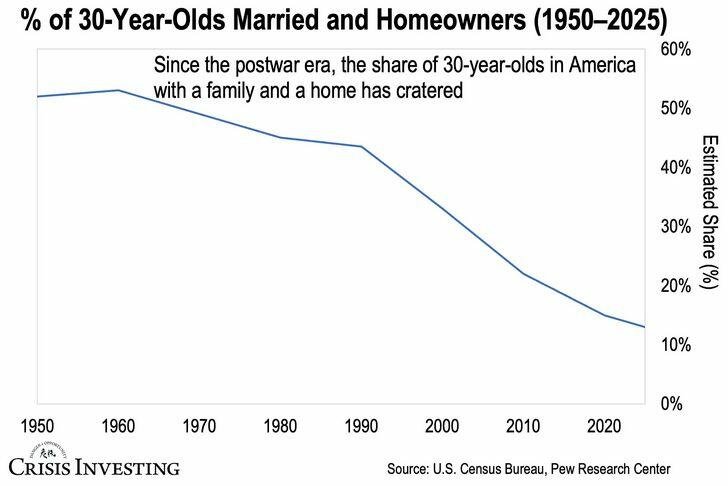

Young Americans, in particular, have felt the brunt of this shift. This week’s chart illustrates the stark reality: since the postwar period, the percentage of 30-year-olds in America with both a family and a home has dropped dramatically—from about 52% in 1950 to just 13% in 2025. That’s a staggering 75% decline over 75 years.

Consider this: in 1950, more than half of 30-year-olds had achieved what many consider essential markers of adult stability—marriage and homeownership. Today, that figure is barely one in eight.

A closer look at the data reveals two distinct phases of decline. From 1950 to 1990, there was a steady but manageable drop; the share of 30-year-olds with both a family and a home fell from 52% to around 43%. This decline reflected gradual social changes we’re familiar with—more women entering the workforce, people marrying later, and shifting cultural attitudes toward marriage.

Then, around 2000, something dramatic occurred. The decline accelerated sharply. Between 1990 and 2025, the rate plummeted from 43% to 13%—a 70% drop in just over three decades.

What’s behind this trend?

We could attribute it to changing cultural preferences—young people prioritizing careers over families and valuing experiences over stability. While that’s certainly part of the narrative, there’s a more pressing economic reality at play. Today’s families would need the combined income of three households just to match the home affordability levels of a single family in 1959.

The situation worsens when we consider the crushing debt burden that weighs on young adults. The very institution meant to prepare them for economic success—college—has become a financial trap. Average student debt more than doubled from $17,297 to $37,850 between 2006 and 2024, with total outstanding student debt soaring from $500 billion to $1.8 trillion.

Now, consider the harsh math facing today’s 30-year-olds. They graduate with an average of $38,000 in student debt, though many leave with debts of $60,000, $80,000, or even six figures. They need an annual income of over $130,000 to afford the average home, all while competing in a job market where wages haven’t kept pace with housing costs.

In essence, they’re entering their prime family-formation years already financially burdened. It’s no surprise that marriage and homeownership rates have plummeted.

The cruel irony is that America’s political class has built a system where the very credentials required for middle-class success have effectively priced young people out of achieving that life.