By Michael Gouvalaris

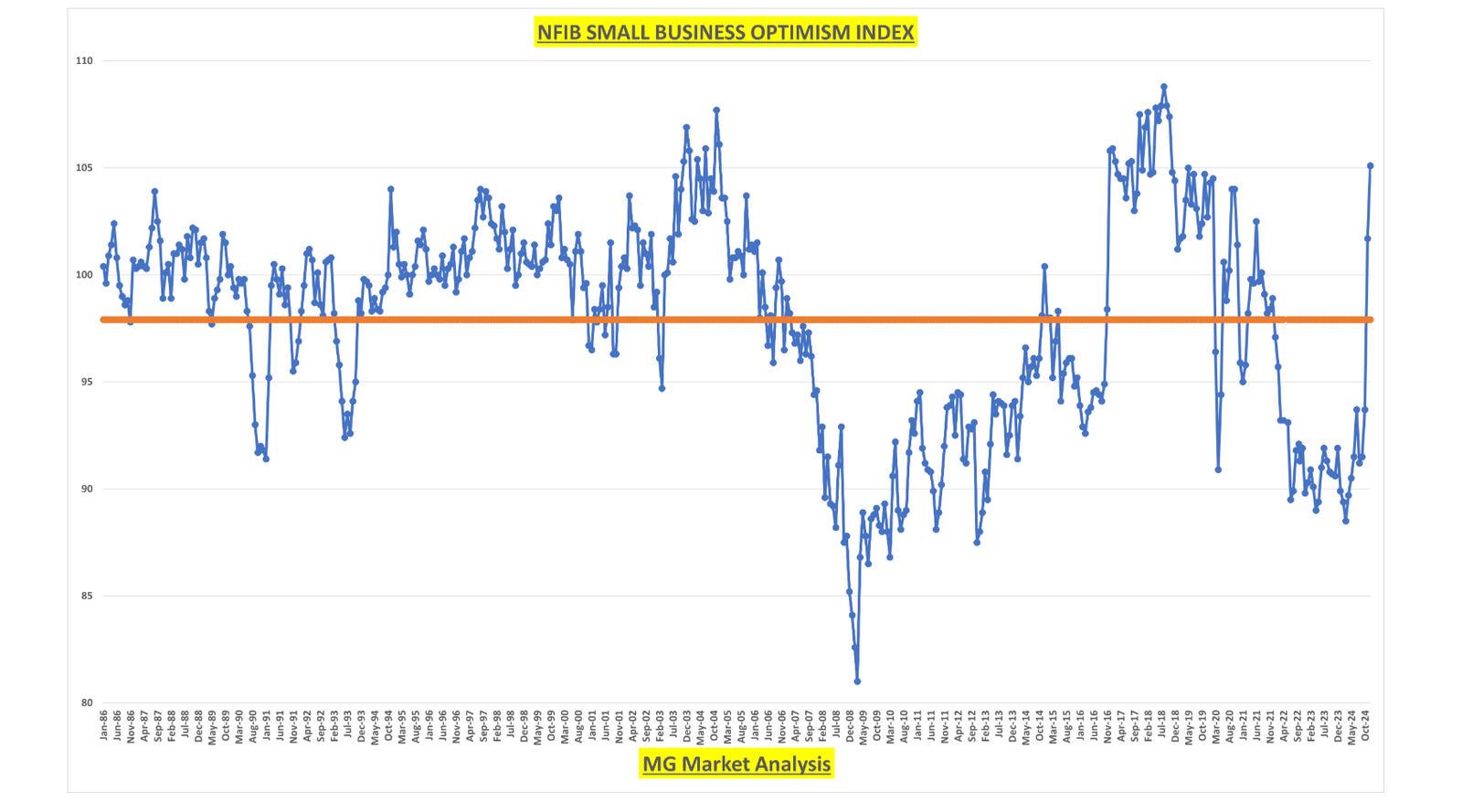

Small business optimism soared for the second straight month, according to the National Federation of Independent Business (NFIB), which has been reporting this data set monthly since 1986. The index hit 105.1 in December, easily beating street expectations of 101.3. After spending almost 3 straight years below the historical average of 98 (orange line), a new trend has seemed to emerge. The last time optimism was this high was back in October 2018.

NFIB Chief Economist Bill Dunkelberg:

“Optimism on Main Street continues to grow with the improved economic outlook following the election. Small business owners feel more certain and hopeful about the economic agenda of the new administration. Expectations for economic growth, lower inflation, and positive business conditions have increased in anticipation of pro-business policies and legislation in the new year.“

Looking at the individual subcomponents, the biggest contributing factor to this month’s gain was respondents’ expectations for the economy to improve. Within the commentary there was an important point that Fed officials and policymakers seem to forget:

“Currently, inflation is under 3 percent, but above the 2 percent Fed target. More likely the issue is the 20 percent increase in selling prices (CPI) since 2020, consumers want prices to fall, not continue to rise even if at a very low inflation rate. Small business owners share the same sentiment, high prices (costs) are the concern, not the rate of price increases.”

The S&P 500 closed its post-election day gap on Monday (black line). So far it’s found support and we are rallying again. From Monday’s low point, so far the pullback has been a little over 5% from the record high in December. But we made a lower high, and lower low on the chart with this weeks decline. We’ll need to watch the 5950-5975 area on this rally, which is the 50% retracement level, the 50-day moving average, and the upper end of the downtrend channel (blue lines). We’ll need to break that resistance area for the uptrend to resume.

It might come down to interest rates. The 10-year rate has already broken above the 2024 high point at 4.737%. It’s now the third straight trading day that the market has accepted prices above that key pivot point. The more time the market accepts prices above, the less likely it’s a shakeout. I don’t see much left in the way of the 2023 highs and the major milestone of 5.0%. The higher rates go, the more expensive stocks become.

Wednesday we’ll start getting Q4 earnings and the all-important CPI inflation report.