Charles Hugh Smith

Markets misbehave, sometimes when we least expect it. How badly they misbehave depends on the soundness of the hull and the level of self-reinforcing hubris.

When Benoit Mandelbrot’s book The (Mis)behavior of Markets was published in 2004, it was a revelation for many of us. I remember sitting in my car in a parking lot, unwilling to tear myself away from reading it.

Here’s the super-short summary: from time to time markets crash for no visible reason. The internal dynamics of market structures are fractal, and one feature of this structure is that markets break down unpredictably. After the fact, we seek an external trigger–a Federal Reserve “policy error,” inflation fears, etc.–but these post-mortem explanations gloss over the cause, which is the inherent instability of market structures.

Markets can trundle along for years appearing to be stable and controllable. Any spot of bother can be corrected with a reduction in interest rates or quantitative easing. Everything is known and controllable.

But this control is illusory. Out of the blue, markets stop behaving. They misbehave, and possibly quite badly.

Nature offers many examples. The seas are relatively calm, and suddenly an enormous rogue wave appears.

At that point, the condition of the ship matters. A sound craft will survive the rogue wave, the leaky, rotten hulk won’t.

Human hubris also matters. If the passengers and crew of the hulk have been persuaded by each other’s happy talk that the ship is rock-solid, then its breaking apart will come as a nasty shock.

In the current zeitgeist, the consensus is the mighty ship of the stock market is a superliner. No matter how big the rogue wave, the ship will handle it easily.

But what if the consensus is wrong, and we’re all passengers on a rotting hulk gussied up with new paint? What if the consensus isn’t based on the soundness of the hull, but on the self-reinforcing happy-talk around the dessert cart and bar?

The consensus is convinced the ship is unsinkable, and so the guaranteed path to profit is to “buy the dip” after the rogue wave has passed. This guarantee is not actually causal; it’s recency bias, as “buy the dip” has worked like magic for 15 years.

Nobody’s interested in leaving the first class casino to get in a lifeboat when guaranteed profits beckon. The question is: how sound is the hull? Who’s actually checking, and who’s just parroting happy-talk? Can we even tell the difference?

In a euphoric speculative bubble, the answer is “no.” In a speculative bubble, “buy the dip” is all you need to know to win big, and continue winning big. So who cares about rogue waves and rotten hulls?

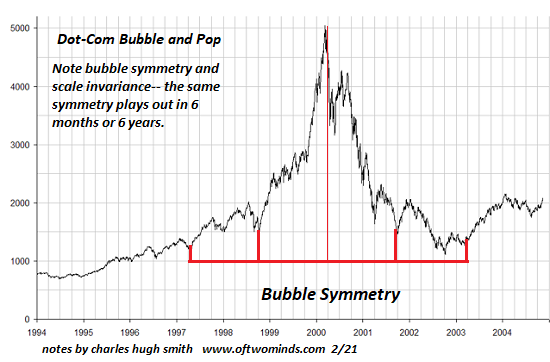

I often refer to this chart of the dot-com bubble because this happened not in some pre-technology era but in the technology-obsessed present. I attended Comdex in Las Vegas in the peak euphoria, and attendees were busy trading stocks online amidst the crowd. Every bubble is forever until it is no more.

Notice the numerous sharp spikes higher as the crowd “bought the dip.” The initial crash was bought with all four feet, which was followed by a secondary crash to a new low, which was immediately bought, generating a euphoric spike that signaled “all clear, buy buy buy!” until it too rolled over. This was followed by one last manic “buy the dip” which resulted in a double-top. Once that petered out, a multi-year stair-step down began. The index eventually bottomed after losing about 80% of its peak valuation.

Markets misbehave, sometimes when we least expect it. How badly they misbehave depends on the soundness of the hull and the level of self-reinforcing hubris.