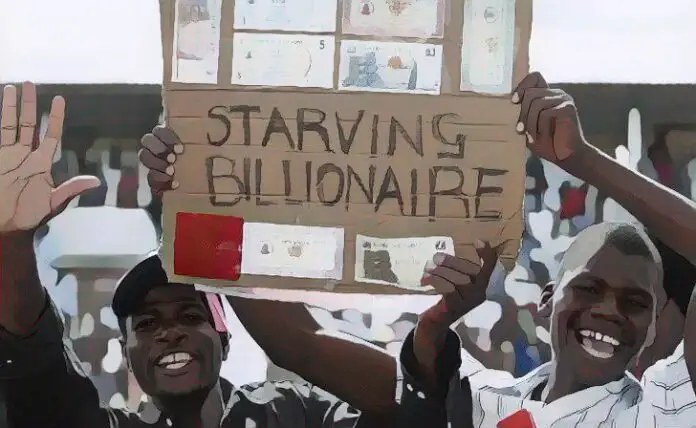

Paper money eventually returns to its intrinsic value – zero.

— Voltaire, 18th century

By Adam Sharp

In films and TV shows set in the future, money is usually a digital government currency.

Credits, cubits, and chits are a few names I recall. This is a globalist CBDC-based vision of the future. Bleak.

But in one of my favorite sci-fi movies, Looper, precious metals reign supreme as money. In that film, the inevitable breakdown in fiat currency has already occurred and hard money has made a comeback.

This latter scenario is far more likely. Time and time again, central banks and governments have proven they cannot be trusted with the power to create unlimited money. It doesn’t matter whether it’s paper or digital money, central bankers will print too much of it given the chance.

Without exception, every fiat currency in history has trended towards zero. Government digital money will be no different.

Voltaire wasn’t exaggerating when he said, “paper money eventually returns to its intrinsic value – zero”. In fact, he had just experienced it first-hand following France’s disastrous fiat experiments of the 1700s.

It’s a question of when, not if. And time is running short.

Our Unusual Fiat Era is Ending

Since 1971, the world has been under a highly unusual 100% fiat monetary system. Not a single country operates on hard money today.

Never before in history was every country simultaneously using fiat. We are living through an incredibly rare, and increasingly dangerous, monetary experiment.

For most of history, developed countries were on a gold and/or silver standard. Coinage was default for thousands of years.

Switching to paper money was always a desperation move. It often happened during or after a major war, when governments were running low on cash. So they switch to fiat to pay the bills, and debase everyone’s savings in the process.

The world has only been on a fiat standard since 1971. Which, not coincidentally, was when the U.S. abandoned the gold standard following huge deficits from the Vietnam War.

It has happened hundreds of times. After it all goes horribly wrong, gold and silver make their inevitable return.

The Dollar Had a Good Run

This fiat period has lasted longer than most. The dollar has been an unusually robust paper currency, and due some clever engineering, it essentially became an oil-backed currency (for many decades, oil producers would only accept dollars for oil).

The dollar will remain an important player for some time to come. But the era of the petrodollar system, where the dollar was the only way to buy oil, is over.

We are entering a new multi-polar era where countries use their own currencies to buy oil and other goods. And the U.S. is no longer the sole superpower.

Central banks around the world are gobbling up gold and diversifying away from the dollar as debt spirals out of control.

We’re approaching the end game now. This is why we’ve been pounding the table on gold and silver so much lately. And it’s why we will continue to going forward.

About Adam Sharp:

The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of Censational Market.