Reuben Gregg Brewer

Warren Buffett is, perhaps, one of the most famous investors of all time. Berkshire Hathaway, his investment vehicle, has trounced the S&P 500 over the long term. Yet, Buffett has said he has no special talent. It’s a good thing for all of us that he also said that you don’t need special talent to be a successful investor.

The talentless Mr. Buffett

Warren Buffett doesn’t paint like Van Gogh, think like Einstein, or hit a home run like Babe Ruth (or Aaron Judge, if you are a modern Yankees fan). There aren’t many people who have achieved such greatness. But this doesn’t mean that Buffett hasn’t achieved great things in his own right.

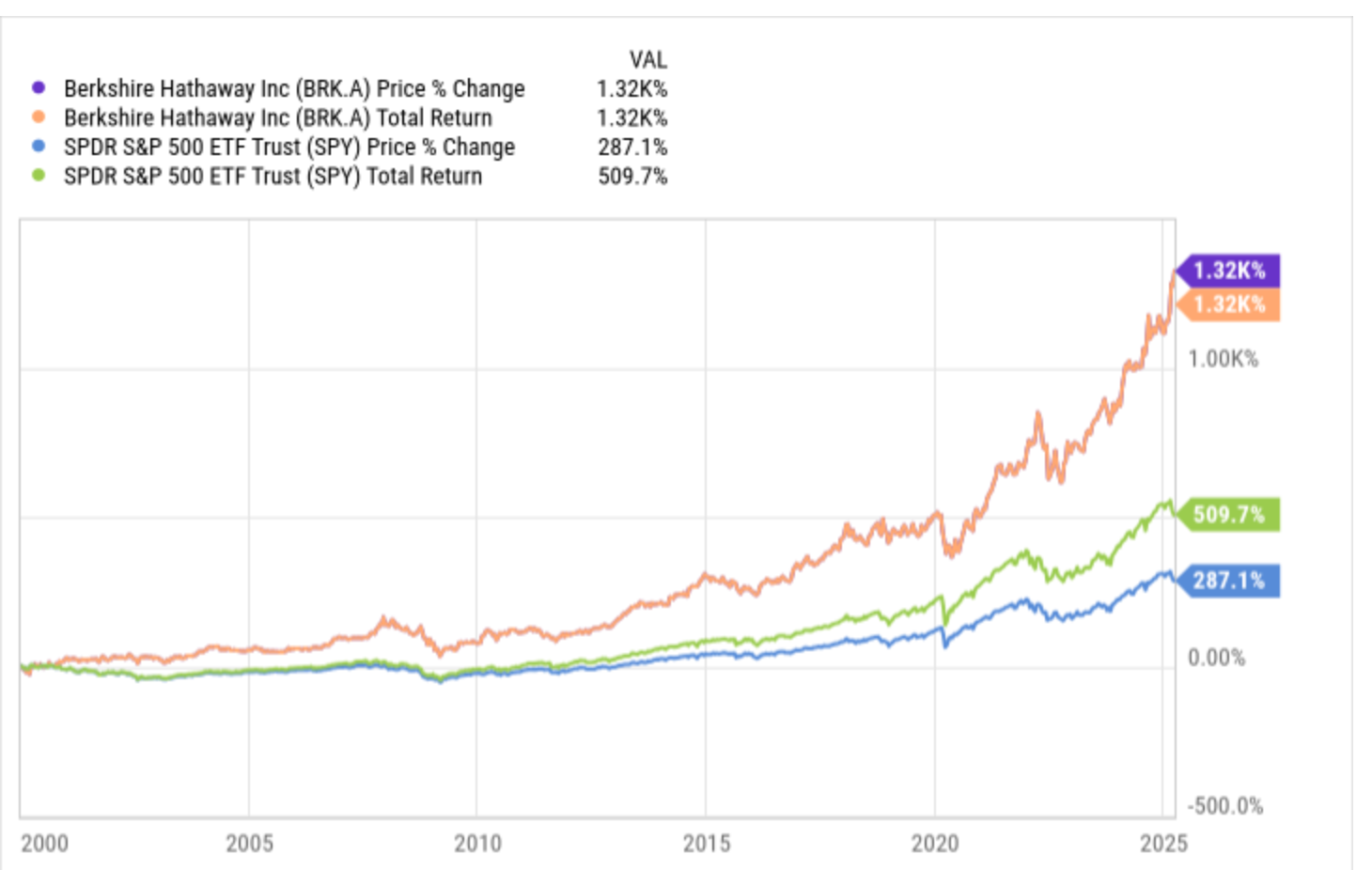

Since just the turn of the century, roughly 25 years, Berkshire Hathaway’s stock price has risen over 1,300%. The S&P 500 index has risen only 280% or so over the same span. Include the reinvestment of dividends in the mix, and the S&P 500 index has provided investors with a total return of roughly 500%. Berkshire Hathaway doesn’t pay dividends, so its total return is equal to its stock price performance, which still trounces the broader market.

It seems like it would be hard to argue that Warren Buffett has no special skill. It seems like his special skill is investing. But he still stated very clearly in Berkshire Hathaway’s 2024 annual report: “Lacking such assets as athletic excellence, a wonderful voice, medical or legal skills or, for that matter, any special talents, I have had to rely on equities throughout my life.”

You can rely on equities, too

Buffett, known for his colloquial wisdom, is making a very interesting statement. He can’t do anything special (like hit three-pointers or write Oscar-worthy movies) that would create fame and wealth out of thin air. Very few of us can. But he can (and you can) buy good companies and benefit from their growth over time. That’s basically all he’s done, if you look at it in a big-picture way.

Sure, Buffett has a style of investing that has clearly worked well for him. But the core of what he is doing is pretty simple. He invests for the long term, and you don’t have to be as good an investor as Buffett to make that work. Berkshire Hathaway has trounced the market, but even just tracking along with the market would result in a huge increase in your wealth.