Recent U.S. Census data analyzed by Harvard University reveals that one in three American households—whether renting or owning—are spending more than the recommended one-third of their income on housing and utilities. This financial strain classifies them as cost-burdened.

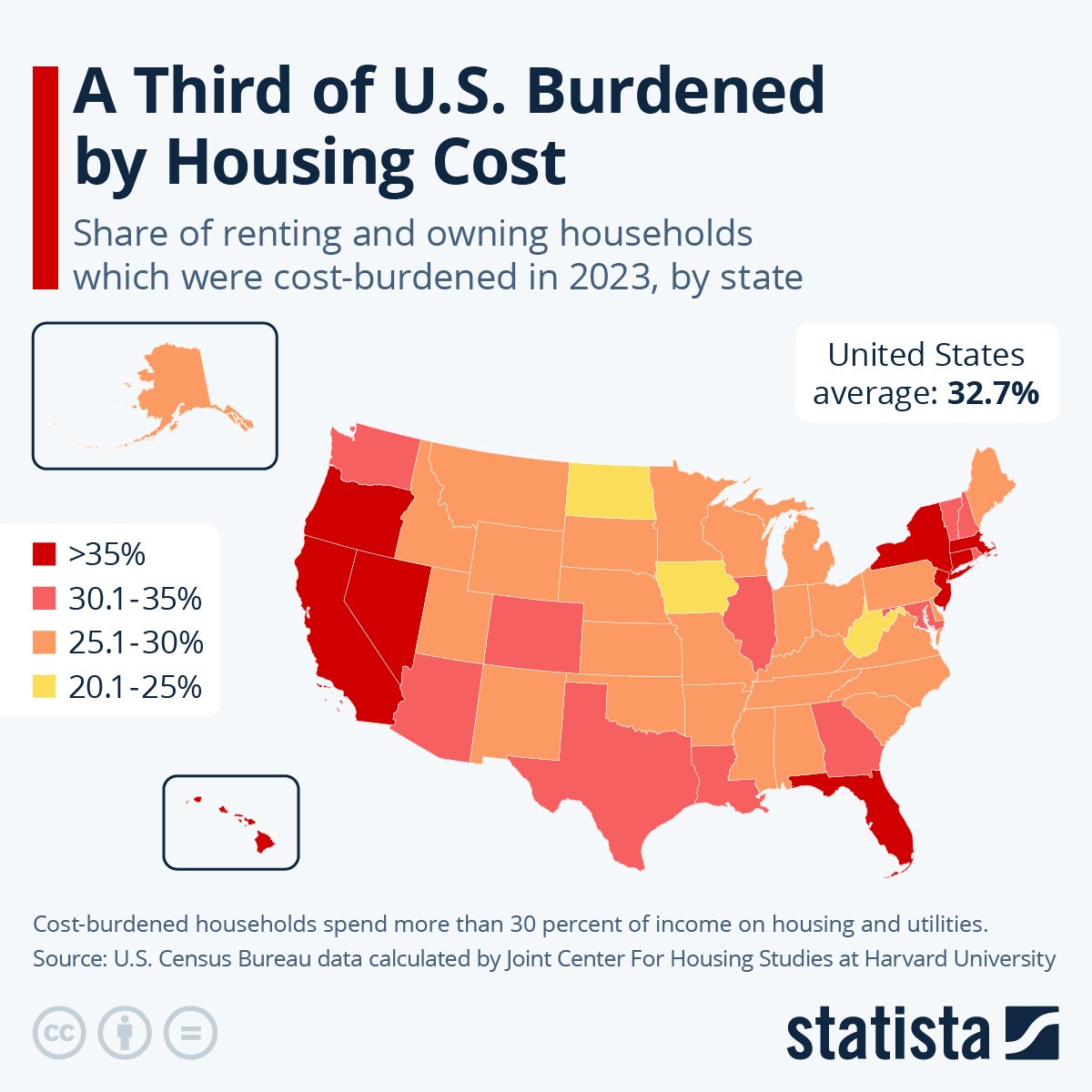

In 2023, the overall rate of households facing housing cost burdens stood at 32.7 percent. However, certain states reported even higher averages.

California, notorious for its steep living expenses, led the way with 41.7 percent of households burdened. It was followed closely by Hawaii at 39.5 percent, Florida at 38.6 percent, and New York at 38.2 percent.

Predominantly, states on the West Coast and those in the densely populated Northeast showed the highest burdens, along with sun-soaked Florida and Hawaii.

In contrast, the least burdened households were found in the Midwest, particularly in West Virginia, North Dakota, and Iowa, where fewer than 25 percent of households reported significant financial strain from housing costs. Colorado and Texas ranked 11th and 12th, respectively.

The report, released this week, indicates that renters are more frequently overburdened by their housing costs compared to homeowners, although this gap has been narrowing in recent years.

Historically, homeowners experienced greater financial strain than renters, but this dynamic shifted in 2012 when rising rents began to weigh heavily on renters while homeowners benefited from low interest rates.

Since the end of the zero-interest era in 2022, homeowners have seen their financial burdens increase, coinciding with economic challenges brought on by inflation that are affecting both renters and owners alike.

The researchers also pointed out that rising insurance premiums and property taxes are significant issues for homeowners. Meanwhile, more than half of renters in 50 out of the 100 largest metro areas in the U.S. are spending over 50 percent of their household income on rent.