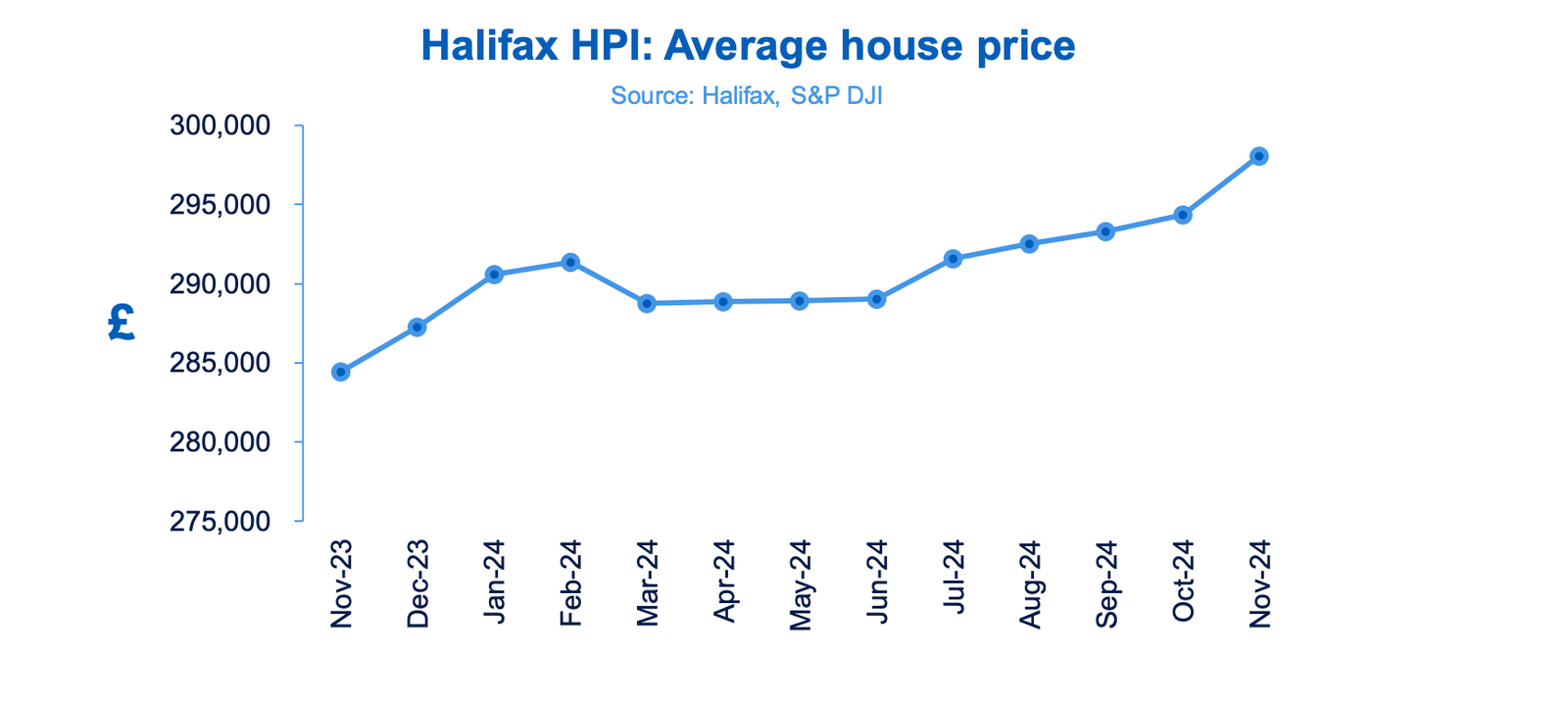

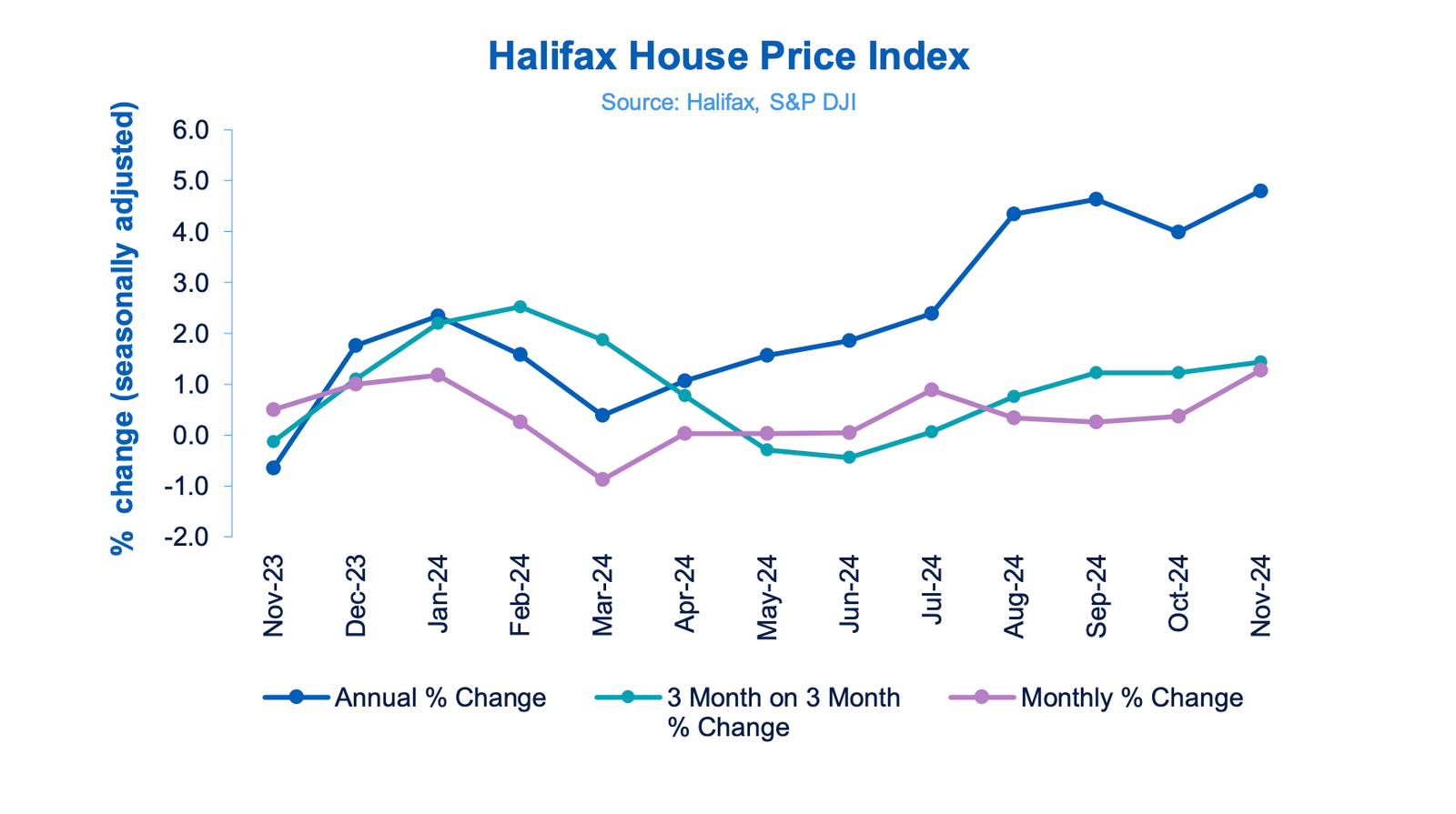

According to Halifax’s latest property data, the average house price in the UK has reached an all-time high. In November, house prices rose by 1.3%, marking the fifth consecutive month of increases. Year-over-year, property prices are up 4.8%, compared to 4.0% last month. The typical property now costs £298,083, setting a new record.

Northern Ireland continues to lead the UK in annual house price growth, with a significant increase of 6.8% in November. The average property price in Northern Ireland is now £203,131.

Wales also saw strong growth, with prices rising 4.1% compared to last year, bringing the average to £225,084. In England, the North West recorded the highest growth, up 5.9%, with properties averaging £237,045.

The West Midlands experienced a notable increase as well, with house prices climbing 5.5% to an average of £257,982. In contrast, Scotland’s growth was more modest, with average property prices rising 2.8% to £208,957.

London retains its position as the region with the highest average house price in the UK, currently at £545,439, reflecting a 3.5% increase from last year.

(House price growth has accelerated in the UK, according to Halifax. Photograph: Halifax)

Amanda Bryden, Head of Mortgages at Halifax, stated that recent figures indicate a rise in mortgage demand, fueled by easing mortgage rates that are boosting buyer confidence. However, she noted that many potential buyers still encounter significant affordability challenges, and this confidence could be tested amid an uncertain economic climate.

Looking ahead to the end of the year and into 2025, Bryden expects that positive employment figures and a potential decrease in interest rates will continue to support demand. While this may lead to further house price growth, she cautioned that the increase is likely to be modest, as borrowing costs remain higher than the average of previous years.

Nicky Stevenson, Managing Director at Fine & Country, commented that the housing market is experiencing strong growth despite challenges posed by the Autumn Budget and inflation. This resilience is fostering hopes for a strong finish to the year.

Stevenson noted that it’s common to see increased activity following changes in policy or economic indicators, as those affected make swift decisions to manage potential costs. However, she cautioned that upcoming tax increases from the Budget could diminish buyer purchasing power, and ongoing economic uncertainty has led to the disappearance of some of the most competitive mortgage rates.

With inflation currently at 2.3%, these tax hikes and rising prices may lead some consumers to tighten their budgets in the new year. Nevertheless, experts remain optimistic about the housing market’s future. Zoopla predicts a 2.5% increase in house prices and a 5% rise in transactions by 2025, with first-time buyers expected to play a crucial role in this growth, aided by improving affordability due to higher incomes and lower mortgage rates.

As these factors unfold, the housing market is entering 2025 with renewed momentum and a positive outlook, suggesting continued growth despite potential challenges.