Staff Reporter

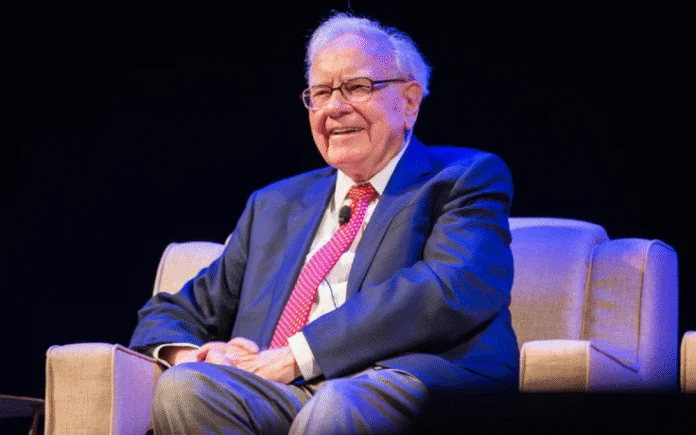

Warren Buffett has revealed that he will step down as CEO of Berkshire Hathaway (NYSE:BRK.A)(NYSE:BRK.B) at the end of the year, ending a remarkable 55-year leadership.

He made this announcement during the company’s annual shareholder meeting, where he named Greg Abel, the current vice chairman overseeing operations, as his successor.

“I think the time has arrived where Greg should become the chief executive of the company at year end,” Buffett stated, expressing confidence that Berkshire will continue to prosper under Abel’s guidance. He also confirmed he has no plans to sell his shares.

Buffett took the reins of Berkshire Hathaway in 1965, transforming it from a struggling textile firm into a trillion-dollar conglomerate. Under his stewardship, the company has seen an impressive annual per-share value growth rate of 19.9%, nearly double that of the S&P 500.

His investment strategies, which include significant stakes in companies like GEICO, Coca-Cola, American Express, and Apple, have solidified his status as one of the most successful investors ever.

While Buffett did not elaborate on his decision to step down, his age and long-term succession planning indicate a natural transition. He will remain involved in an advisory role, although Abel will now have the final say on major decisions. Buffett’s departure signals the end of an era, but his legacy as the “Oracle of Omaha” will endure.

Highlights of Buffett’s Best and Worst Investments

Buffett’s Best Investments

- National Indemnity and National Fire & Marine: Acquired in 1967, this was one of Buffett’s first ventures into insurance, providing crucial capital for many of Berkshire’s investments. The insurance division now includes Geico and General Reinsurance, with a float totaling $173 billion.

- American Express, Coca-Cola, and Bank of America: Buffett bought shares in these companies when they were out of favor due to scandals or market conditions, generating over $100 billion in value since.

- Apple: Initially hesitant about tech investments, Buffett began purchasing Apple shares in 2016, recognizing its strong consumer base. His investment has grown to more than $174 billion.

- BYD: Following advice from his late partner Charlie Munger, Buffett invested $232 million in the Chinese electric vehicle maker in 2008. The stake soared to over $9 billion before he began selling off portions.

- See’s Candy: Buffett considers this 1972 purchase a career-defining moment. He paid $25 million and earned $1.65 billion in pretax profits through 2011, highlighting the importance of buying strong businesses at good prices.

- Berkshire Hathaway Energy: This utility investment has provided substantial profits, contributing over $3.7 billion to Berkshire’s earnings in 2024, despite recent challenges related to wildfire liabilities.

Buffett’s Worst Investments

- Berkshire Hathaway Textile Mills: Buffett has called this his worst investment, as it lost money for years before shutting down in 1985. However, the shares he bought for $7-$8 are now worth $809,350 each.

- Dexter Shoe Co.: He admitted that acquiring Dexter for $433 million in 1993 was a major blunder, as he used Berkshire stock for the deal.

- Missed Opportunities: Buffett has acknowledged that failing to invest in companies like Amazon, Google, or Microsoft—along with missing a chance to buy 100 million Walmart shares—were significant missteps.

- Selling Banks Too Soon: In the lead-up to the COVID pandemic, Buffett offloaded shares in major banks like Wells Fargo and JP Morgan, which have since more than doubled in value.

- Blue Chip Stamps: After taking control in 1970, declining sales led to a significant drop in revenue. However, the float generated contributed to acquiring other profitable companies.

The Services and the Content are provided to you solely for your general informational purposes, and should not be considered as legal, tax, accounting, financial or investment advice.You are solely responsible for determining whether any investment is suitable for you, considering your investment objectives, risk tolerance and personal financial situation. It is also your responsibility to evaluate the merits and risks of using the information provided on this site before making any decisions.