Staff Reporter

In the three weeks since President Trump declared “Liberation Day” on April 2 and imposed new tariffs, a significant shift in the economic landscape has taken place.

This change has sent shockwaves through global markets, prompting a rapid reassessment of risk factors and altering perceptions of economic activity, financial assets, trade policies, and safe havens.

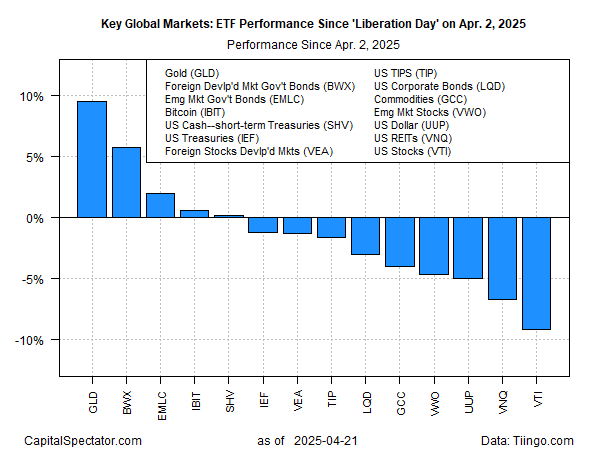

Given this upheaval, it’s worth examining key market performances from the April 2 starting point. The previous economic order feels like a thing of the past, with many aspects now seemingly irrelevant. The summary below highlights the winners and losers since the onset of Liberation Day, based on various ETFs up to April 21.

Leading the pack is gold (GLD), which has surged by 9.7% in what can be termed the Great Financial Reset. Following closely are government bonds from developed markets outside the U.S. (BWX), up 6.0%, and bonds from emerging markets (EMLC), which have seen a 2.1% increase.

Bitcoin (IBIT) has managed a modest gain of 0.6%, while cash (SHV), based on short-term U.S. Treasuries, has edged up 0.2%.

On the other hand, U.S. stocks (VTI) have faced a significant downturn, plummeting by 9.1%. Other notable declines include U.S. real estate investment trusts (VNQ), the U.S. dollar (UUP), and stocks in emerging markets (EMLC).

The key question now is how long this Great Financial Reset will last and whether it marks a permanent shift in the financial landscape. Ongoing debates reflect the uncertainty surrounding these changes.

What’s evident is that traditional assumptions about market behavior are being challenged.

Investors are grappling with multiple dramatic shifts occurring simultaneously, particularly regarding tariffs and concerns about the Federal Reserve’s independence after President Trump’s recent criticisms of Chairman Powell.

Additionally, there are pressing macroeconomic questions regarding the potential for rising inflation to slow growth, which could lead to a recession in the U.S. in the near future.

For now, asset allocation remains critical, as there will always be winners and losers. However, the Great Financial Reset serves as a reminder that assumptions about who will succeed or fail are not set in stone.