Staff Reporter

Back in 2015, investors faced a pivotal choice that has since shaped their financial futures. Some decided to buy shares of Nvidia (NVDA 3.10%), while many opted out. Regardless of the choice, a decision was made—whether intentional or not.

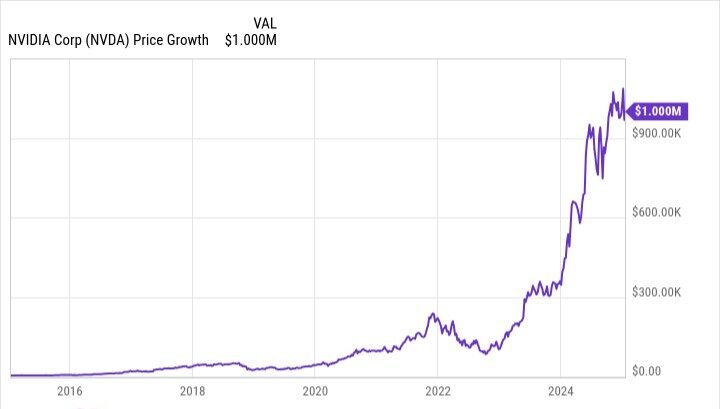

For those who didn’t jump on the Nvidia bandwagon, the regret is palpable now. Nvidia has emerged as one of the market’s standout performers. Investors who purchased and held onto their shares of the graphics processing unit (GPU) powerhouse are now enjoying significant financial rewards. Here’s a look at how much you would have needed to invest in Nvidia stock a decade ago to become a millionaire today.

An Astonishingly Low Investment for Massive Gains

Most investors would be thrilled with a stock that turns into a tenfold gain over a decade. But what word can capture the excitement of a stock that has skyrocketed by 28.5 times? That’s the impressive journey Nvidia has taken since January 2015.

However, the story doesn’t end there. Nvidia launched its dividend program in 2012, and while the dividend yield may be modest, reinvesting those dividends over the years has significantly boosted returns. In fact, Nvidia’s total return over the past ten years exceeds 29.6 times the initial investment.

You might be surprised at how little money is required to grow into $1 million over a decade with such outstanding returns. If you had invested just $3,625 in Nvidia stock back in January 2015 and held onto it, your investment would now be worth a staggering $1 million.

Signs in 2015 Indicating Nvidia’s Potential for Massive Success

Back in 2015, few investors could have predicted Nvidia’s remarkable rise as a money-making powerhouse. However, there were indeed signs pointing to the company’s potential.

Nvidia’s latest quarterly regulatory filing at the time, which covered its fiscal 2015 third-quarter results, was submitted in November 2014. In that filing, Nvidia highlighted data centers as one of its primary target markets. They noted that in the second quarter of fiscal 2015, “We extended our reach in data center accelerated computing, with the world’s 15 most highly efficient supercomputers all utilizing our Tesla GPUs.” This statement hinted at Nvidia’s growing influence in the data center sector.

Additionally, it was widely recognized that Nvidia’s GPUs were particularly effective in powering artificial intelligence (AI) applications. The company made this clear in its annual report filed in March 2015, mentioning its chips’ use in deep learning on ten separate occasions.

Moreover, it was easy to see that AI was on the verge of significant growth. A report from the Pew Research Center published in August 2014, titled “Predictions for the State of AI and Robotics in 2025,” featured experts who predicted an AI boom over the coming decade. DotSUB CEO David Orban made a striking prediction, stating, “It will be natural to talk to computers of any shape, and expect them to understand the words, and the meaning, and to establish a dialog leading rapidly to the desired goal.”

Is Nvidia Still a Pathway to Millionaire Status?

Could investing $3,625 in Nvidia stock today make you a millionaire in ten years? Probably not. However, Nvidia may still hold the potential to create millionaires over the next two decades for those willing to invest $200,000 or more.

Nvidia’s GPUs are in high demand for training and deploying artificial intelligence (AI) models. The company is rolling out new, more powerful chips at an unprecedented rate. With the potential arrival of artificial general intelligence (AGI) in the coming years, Nvidia could tap into an even larger market.

For investors seeking stocks that could transform a modest investment into $1 million over the next decade, it might be wise to explore other options. The quantum computing market, for example, could present such opportunities.

The Services and the Content are provided to you solely for your general informational purposes, and should not be considered as legal, tax, accounting, financial or investment advice.You are solely responsible for determining whether any investment is suitable for you, considering your investment objectives, risk tolerance and personal financial situation. It is also your responsibility to evaluate the merits and risks of using the information provided on this site before making any decisions.