Staff Reporter

Nvidia (NVDA) has seen a modest increase of about 3.4% in 2025, falling just short of the S&P 500’s 4% gain this year. This might seem surprising for the tech giant known for its dominance in artificial intelligence (AI), especially after its impressive 171% surge in 2024, while the S&P 500 climbed over 23%.

But let’s take a step back. If you had invested $1,000 in Nvidia stock five years ago, would you be enjoying a profitable return today, or would your investment still be in recovery mode?

A Semiconductor Leader Soaring to New Heights

Nvidia has truly skyrocketed in the semiconductor industry, establishing itself as a powerhouse in artificial intelligence (AI) and beyond.

While AI stocks have only recently caught the attention of many investors, Nvidia was already positioning itself as a leader back in 2020 with its acquisition of Swiftstack, a data storage company whose technology was integral to Nvidia’s graphics processing units (GPUs). This marked the beginning of a series of strategic acquisitions aimed at fueling aggressive growth.

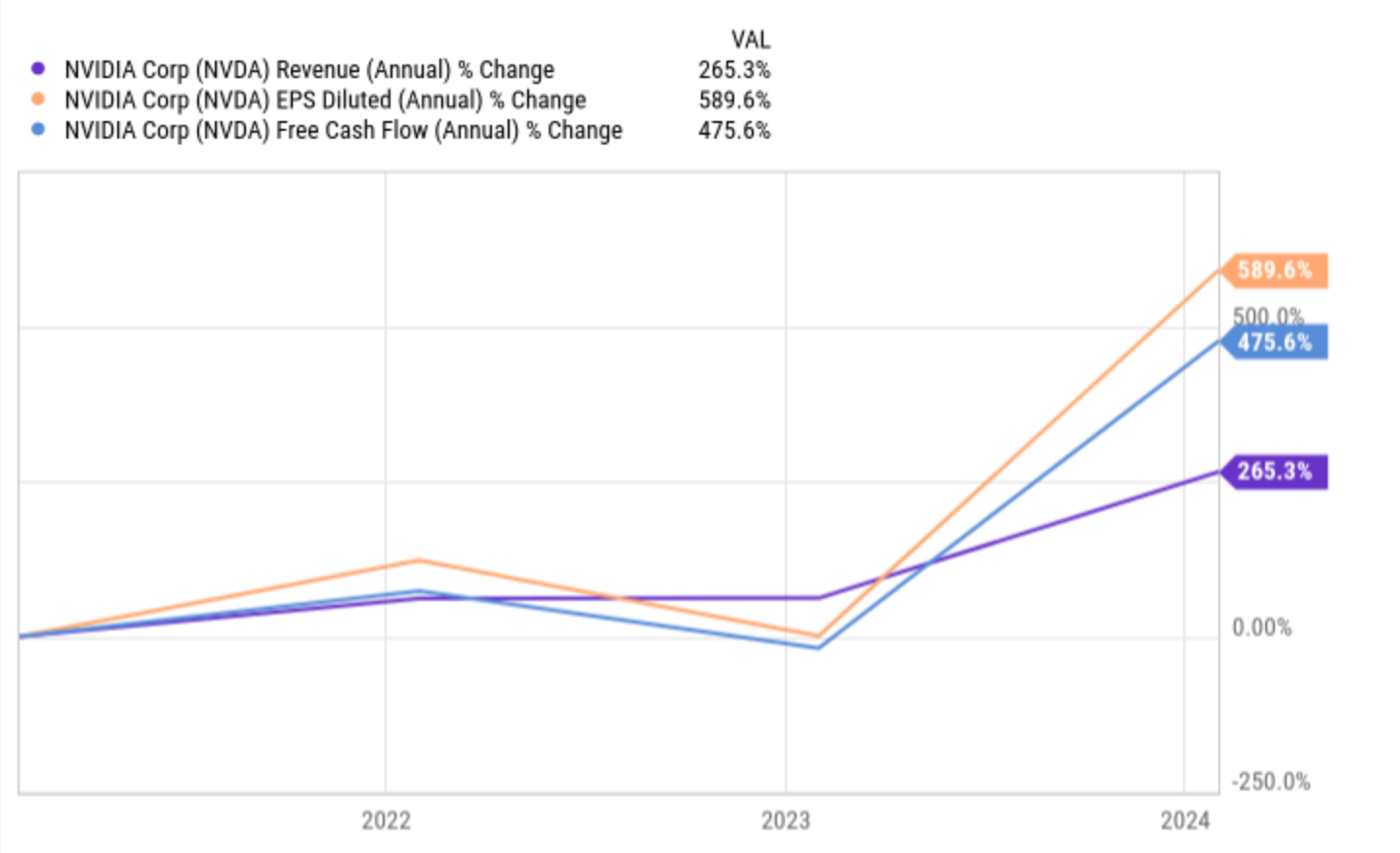

Over the past five years, Nvidia has not only expanded its intellectual property portfolio but also made significant strides in various financial metrics.

As demand for its GPUs and semiconductors continues to rise, Nvidia has reported impressive growth in revenue, earnings, and free cash flow, providing ample reasons for investors to celebrate.

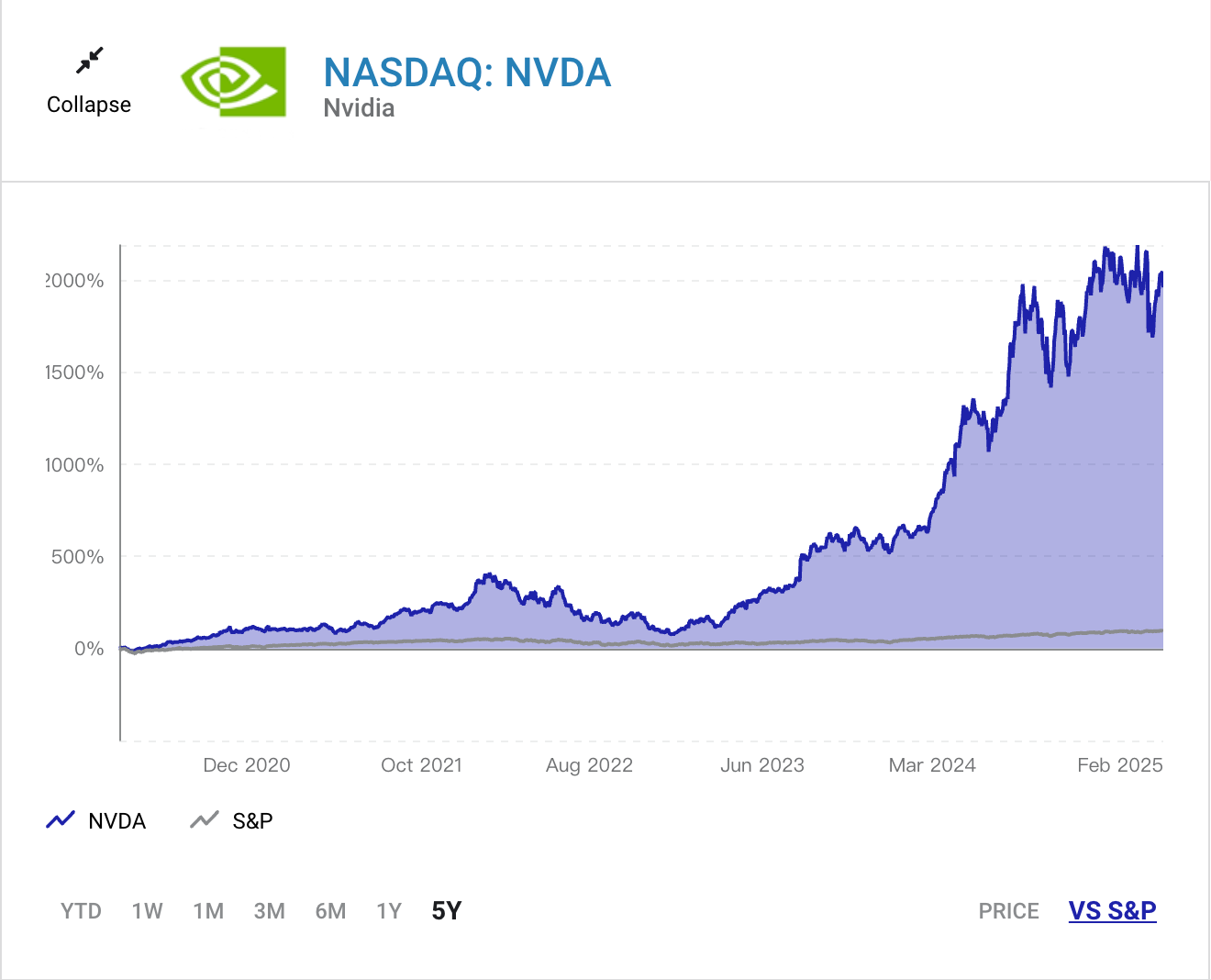

The market has consistently rewarded Nvidia for its accomplishments, driving its stock price up an astounding 1,820%. If you had invested $1,000 in Nvidia stock five years ago, your investment would now be worth approximately $19,270.

The Services and the Content are provided to you solely for your general informational purposes, and should not be considered as legal, tax, accounting, financial or investment advice. You are solely responsible for determining whether any investment is suitable for you, considering your investment objectives, risk tolerance and personal financial situation. It is also your responsibility to evaluate the merits and risks of using the information provided on this site before making any decisions.