Staff Reporter

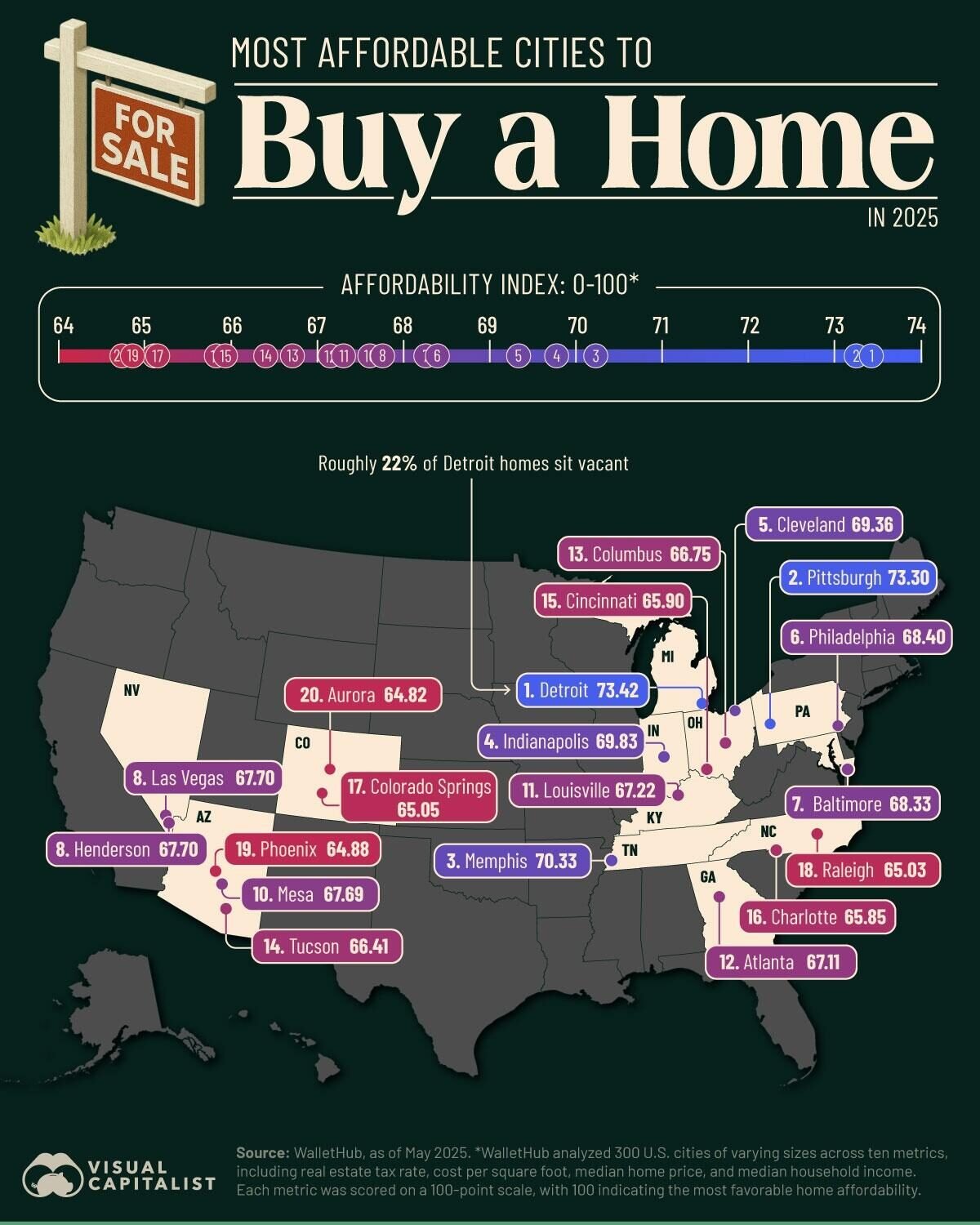

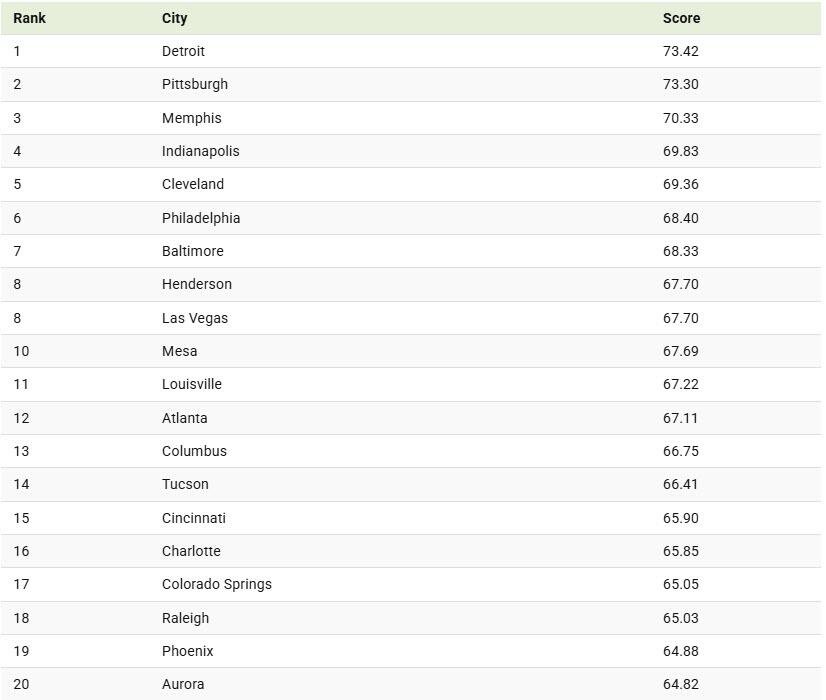

WalletHub has evaluated 300 U.S. cities of various sizes based on ten key metrics, including real estate tax rates, cost per square foot, median home prices, and household incomes.

Each metric was scored on a 100-point scale, where 100 represents the best conditions for home affordability. This analysis focused on cities with populations over 100,000.

According to a map created by Visual Capitalist’s Bruno Venditti, here are the 20 most affordable U.S. cities to buy a home in 2025, based on WalletHub’s findings.

Detroit Leads the Way

Detroit tops the list, with a median price per square foot of around $87. The city has faced numerous challenges over the years, including financial setbacks and the decline of the auto industry, leading many residents to relocate.

Currently, over 22% of homes in Detroit are vacant, fostering a strong buyer’s market. WalletHub reports that Detroit is one of the best cities for long-term home value compared to renting. Another study also named it the most affordable large American city in 2025.

In the Rust Belt, Pittsburgh, PA, ranks as the second-most affordable city for homebuyers, with a median home price about 3.8 times the median household income. Similarly, Memphis, TN, which ranks third, is recognized as one of the most affordable large cities in the country for working families.

Why It Matters

The cost of homeownership has become a significant barrier for many Americans. Over the past six years, the median home sales price in the U.S. has skyrocketed from $313,000 in Q1 2019 to $416,900 in Q1 2025.

At the same time, the average 30-year fixed mortgage rate jumped from 2.65% in January 2021 to 6.81% in May 2025.

This combination of rising prices and increased borrowing costs has pushed many potential homeowners out of the market, making affordability rankings more crucial than ever.

While some areas are starting to see a decline in home prices and an uptick in inventory, challenges remain, particularly in coastal and major metropolitan regions.

Homebuyers now face a tough situation: inflated prices coupled with higher monthly payments. This has made it increasingly difficult for first-time buyers, even as homeownership remains a key goal for many families.

However, there may be a glimmer of hope for prospective buyers. Recent data from the National Association of Realtors indicates a possible shift.

Existing home sales fell by 0.5% in April 2025 compared to March, while inventory increased by 9%.

Even with fewer sales, the national median existing-home sales price rose by 1.8% year-over-year to $414,000, setting another record high for April prices.