Staff Reporter

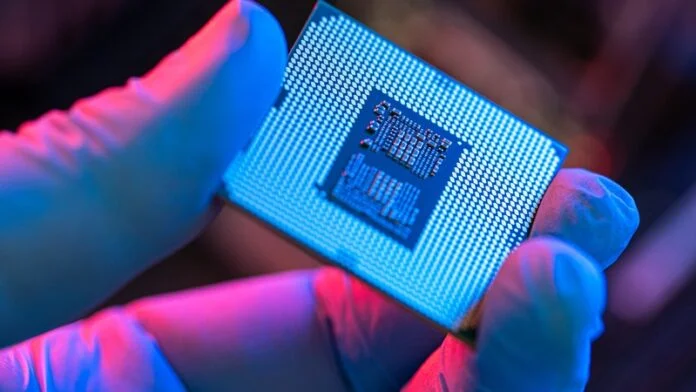

Semiconductors play a crucial role in everything from cars to computers, often found in numerous devices. Recently, President Trump announced that tariffs on semiconductors will be implemented “in the very near future,” prompting tech companies to search for ways to mitigate potential impacts on their operations.

- Taiwan Semiconductor (TSMC)

Potential tariffs on semiconductors could significantly affect Taiwan Semiconductor (TSMC), the world’s largest processor manufacturer.

TSMC produces chips for major companies like Apple (AAPL), Nvidia, and Qualcomm, accounting for an estimated 90% of the world’s most advanced processors.

If tariffs are enacted, TSMC could face higher production costs, leading to increased prices for its customers, which would ultimately raise costs for the many products that rely on TSMC’s chips.

During a recent earnings call, CEO C.C. Wei addressed tariff concerns, stating, “We understand there are uncertainties and risks from potential tariff policies.

However, there hasn’t been any change in our customers’ behavior so far. We continue to expect a revenue increase of close to mid-20s percent in U.S. dollar terms for the full year 2025.”

Currently, TSMC plans to invest $165 billion in U.S. chip production to meet rising demand from American clients. This investment might help mitigate the impact of future tariffs.

However, the company acknowledged that the looming threat of semiconductor tariffs brings “uncertainties and risks,” with a clearer understanding expected by the second quarter.

- Apple

Apple is already feeling the pinch from current tariffs, with an additional $900 million in costs reported last quarter. Analysts suggest future tariffs could double these costs for the company.

The situation could worsen if semiconductor tariffs are introduced, as Apple sources chips from Taiwan, South Korea, Japan, and Singapore.

These chips are vital for the company’s range of products, including iPhones, computers, tablets, smartwatches, and AirPods.

Tariffs on processors could force Apple to increase iPhone prices to maintain its typical profit margins, or they may absorb some of the costs to lessen the impact on consumers.

Despite the uncertainty surrounding tariffs, Apple is preparing by sourcing more semiconductors from U.S. facilities.

CEO Tim Cook mentioned during the earnings call, “In 2025, we expect to source over 19 billion chips from a dozen states, including tens of millions of advanced chips produced in Arizona this year.”

Additionally, Apple plans to invest $500 billion in the U.S. over the next four years, including funds to expand TSMC’s manufacturing in Arizona.

However, Cook cautioned against optimism, stating, “I don’t want to predict the future because I’m not sure what will happen with tariffs,” and expressed difficulty in anticipating developments beyond June.

The Services and the Content are provided to you solely for your general informational purposes, and should not be considered as legal, tax, accounting, financial or investment advice. You are solely responsible for determining whether any investment is suitable for you, considering your investment objectives, risk tolerance and personal financial situation. It is also your responsibility to evaluate the merits and risks of using the information provided on this site before making any decisions.