By Dave Kovaleski

There were some major moves away from banks.

Last week, Berkshire Hathaway (NYSE:BRKa) filed its 13F report with the Securities and Exchange Commission (SEC), detailing the stocks it bought and sold in Q1.

While there weren’t a huge number of changes in the quarter, there were some notable shifts, including a significant move away from banks.

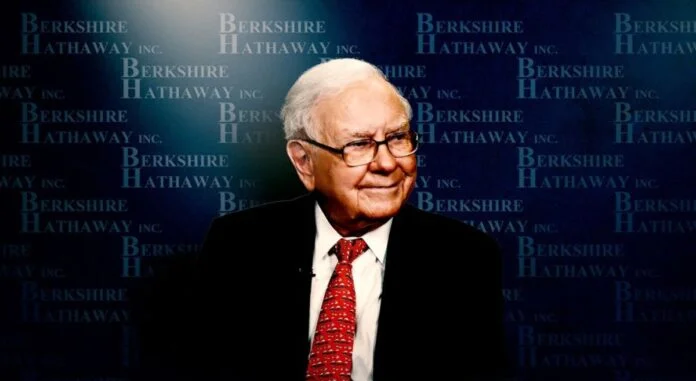

Warren Buffett, the soon-to-be retired CEO of Berkshire Hathaway, has made no secret over the years about his affinity for bank stocks. It shows by the fact that Berkshire’s portfolio over the years has been dominated by banks and financial companies.

But, judging by some of the moves made in Q1, he is less bullish on where banks are headed in this market.

Cutting Bank of America, Citi, and Capital One

For example, in the first quarter, Buffett sold off some 48 million shares of Bank of America (NYSE:BAC), a stock that had, as recently as a year ago, been the second largest holding in the portfolio. Its assets in the portfolio went from $41 billion in Q2 of 2024 down to $26.3 billion in Q1 of 2025. In Q1, Bank of America assets were slashed 7%.

Bank of America is now the fourth largest holding behind Apple (NASDAQ:AAPL) at $66.6 billion, American Express (NYSE:AXP) at $40.8 billion, and Coca-Cola (NYSE:KO) at $28.6 billion.

Notably, Buffett made no changes to Apple in Q1, after significant cuts in recent quarters. While still the largest Berkshire holding, representing about 26% of the $258.7 billion portfolio, Apple is down considerably from where it was. At the end of 2023, Berkshire Hathaway held about $174 billion worth of Apple stock, which represented almost 50% of the $350 billion portfolio.

Since then, the Apple stake has shrunk 62% and the overall portfolio has dropped about 26% to $258 billion.

But back to banks, Bank of America was not the only one Buffett slashed in Q1. Buffett also reduced his stake in Capital One (NYSE:COF) by 4% to $7.1 billion. Capital One just closed on its $35 billion acquisition of Discover Financial.

In addition, Buffett and Berkshire completely sold out of two banks, Citigroup (NYSE:C) and Brazilian online bank Nu Holdings (NASDAQ:NYSE:NU). Buffett sold the remaining 14 million-plus shares in Citigroup, valued at $1 billion, and sold the remaining 40 million shares in Nu, valued at about $416 million.

Beer Run

Among the stocks Buffett added in Q1 was Constellation Brands (NYSE:STZ), the maker of beer, wine and liquor, including Modelo and Corona.

Berkshire bought 6.3 million more shares of Constellation, increasing its stake in the portfolio by 77% to $2.2 billion.

Another big add was to Verisign (NASDAQ:VRSN), a technology company that is a leading provider of internet domains. Berkshire increased its stake in Verisign by 23% to $3.37 billion, adding some 18,000 shares.

Buffett also increased the firm’s stake in Pool Corp. (NASDAQ:POOL), a distributor of swimming pool equipment and supplies. Berkshire bought 865,000 more shares of Pool Corp. stock, increasing its value by 128% to $464 million.

Other adds include Domino’s Pizza (NYSE:DPZ) (NASDAQ:DPZ), Occidental Petroleum (NYSE:OXY), Sirius XM (NASDAQ:SIRI), and Heico Corp. (NYSE:HEI).

The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of Censational Market.

The Services and the Content are provided to you solely for your general informational purposes, and should not be considered as legal, tax, accounting, financial or investment advice.You are solely responsible for determining whether any investment is suitable for you, considering your investment objectives, risk tolerance and personal financial situation. It is also your responsibility to evaluate the merits and risks of using the information provided on this site before making any decisions.