Staff Reporter

In 1953, the Kuwait Investment Authority established itself as the world’s first sovereign wealth fund, created to effectively manage the nation’s surplus oil revenue. Since that pivotal moment, a multitude of funds have emerged globally, with the top 100 collectively amassing an impressive $13.7 trillion in assets.

Sovereign wealth funds are significant financial reserves managed by governments, often found in resource-rich nations like Saudi Arabia and Kuwait. Additionally, countries with substantial foreign-exchange reserves, such as China and Singapore, also maintain these large investment pools.

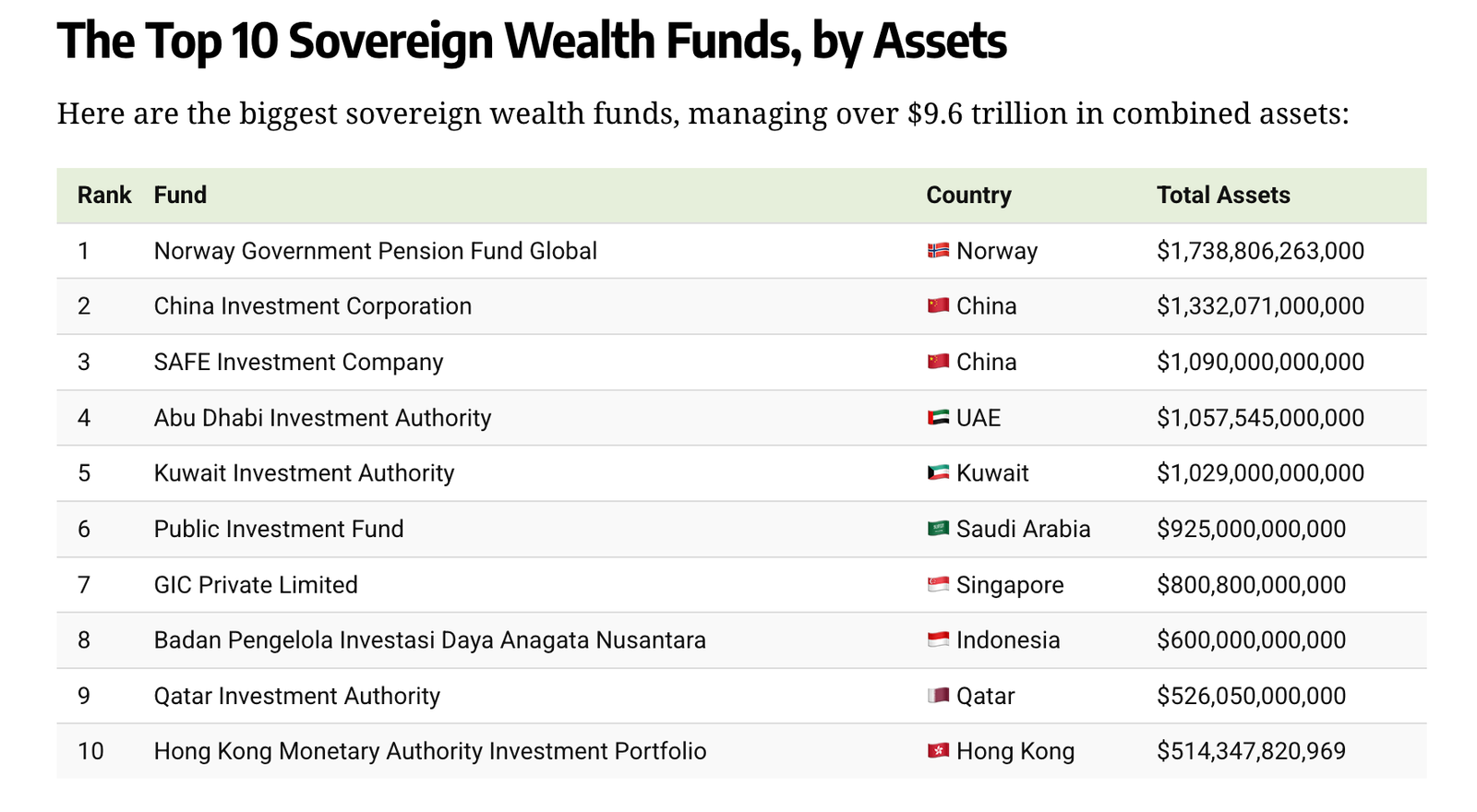

This graphic, via Visual Capitalist’s Dorothy Neufeld, shows the world’s largest sovereign wealth funds, based on data from the Sovereign Wealth Fund Institute.

The Top 10 Sovereign Wealth Funds, by Assets

Here are the largest sovereign wealth funds in the world, collectively managing over $9.6 trillion in assets:

Norway leads with the largest sovereign wealth fund globally, driven by its substantial oil and gas production in the North Sea, which accounts for 10% of the country’s GDP.

In 2024, this fund recorded an impressive $222 billion in profit, largely propelled by strong performance in the tech sector. Notable holdings include major players like Apple, Microsoft, and Nvidia.

Following Norway are China’s two largest sovereign wealth funds, which together hold $2.4 trillion in assets. These funds are crucial in financing the Belt and Road Initiative and other key industries.

Billions have been directed into railroads, green energy, and mining projects across Africa, with Chinese investments in the region now 2.5 times greater than those from all Western nations combined.

Ranking fifth is the Public Investment Fund of Saudi Arabia, with $925 billion in assets. Over the past decade, this fund has made significant investments, including a $3.5 billion stake in Uber, along with notable investments in Nintendo and Heathrow Airport. Looking ahead, the fund plans to invest $1 billion in the sports streaming service DAZN by 2025.

America’s First Sovereign Wealth Fund

In early February, President Trump signed an executive order to establish America’s first sovereign wealth fund, though the source of its financing remains uncertain.

Typically, sovereign wealth funds are funded by budget surpluses, but the U.S. is currently grappling with a $1.8 trillion deficit. This marks the fifth consecutive year that the deficit has exceeded $1 trillion. While Trump indicated that the fund could be utilized to acquire TikTok, ensuring its continued operation in the U.S., the fund is not expected to be fully operational for another year.