By Dr James Fox

The Lloyds share price could push as high as 80p in 2025, according to one highly respected analyst.

The Lloyds(LSE:LLOY) share price is too cheap by 20% according to the consensus of all analysts covering the stock. However, one analyst at Deutsche Bank believes the British lender is undervalued by 46%, with a share price target of 80p.

Why might Lloyds be undervalued

In recent years, Lloyds has typically been undervalued for several reasons. Firstly, it’s a heavily UK-focused bank, with the majority of its loans being UK mortgages. Investors will be familiar with the general malaise affecting British stocks, especially those that are deeply interconnected with the British economy.

Secondly, it doesn’t have an investment arm. Many larger banks have investment and commercial operations, and this provides a degree of diversification. In theory, this means Lloyds is a riskier prospect than the likes of Barclays, which operates a large investment arm.

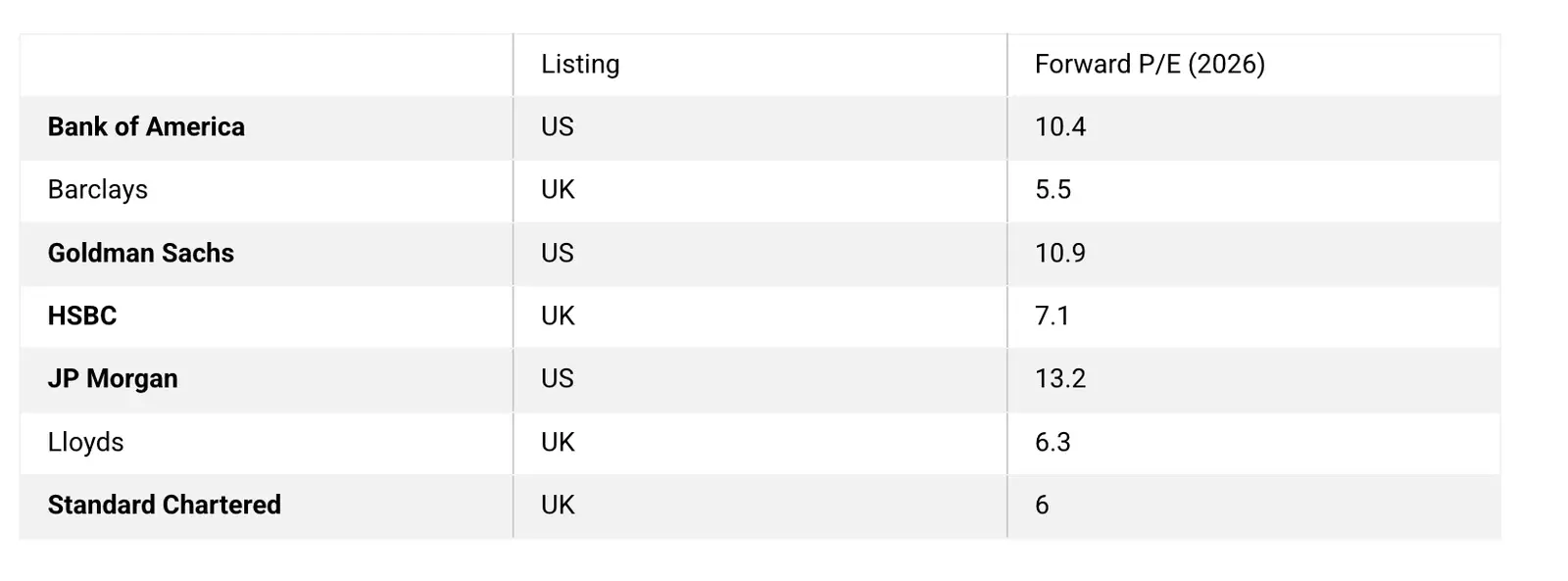

And then there’s the broader transatlantic discount. UK-listed stocks are typically trading at a sizeable discount to their American peers. Just take a look at these price-to-earning (P/E) comparisons. I’ve used 2026 data due to anomalies in the near term.

The difference is stark. While UK banks may not trade in line with US banks for some time, due to factors like a faster growing American economy, but many analysts suggest the discount should not be as large as it is.

There’s a lot to digest here, but there’s certainly cause to believe that Lloyds could trade with higher valuation multiples. Of course, there’s the issue of mis-sold motor finance, which will likely mean Lloyds incurs a very large fine at some point in 2025.

Deutsche Bank’s top pick

Robert Noble at Deutsche Bank is bullish on UK banks, even since the largely regrettable Labour budget in October. The analyst anticipates an improvement in mortgage margin growth as interest rates normalise over the medium term. He also prefers domestic UK banks for their predictable revenue and tangible book value growth over international competitors.

As such, Lloyds, a UK-focused lender, is Noble’s pick of the bunch. Although he recently lowered his price target from 83p to 80p, he remains the most bullish of all analysts on the bank. This infers significant potential for the stock to appreciate in 2025.

The average share price target among all analysts is currently 63p.