Staff Reporter

In a reflection of its status, the United States stands as the world’s largest consumer economy. But just how much do Americans spend on essential goods and services? And which items take the largest share of their spending?

Visual Capitalist’s Pallavi Rao has analyzed data from the Bureau of Labor Statistics to shed light on these questions.

Where Americans Spend Their Money

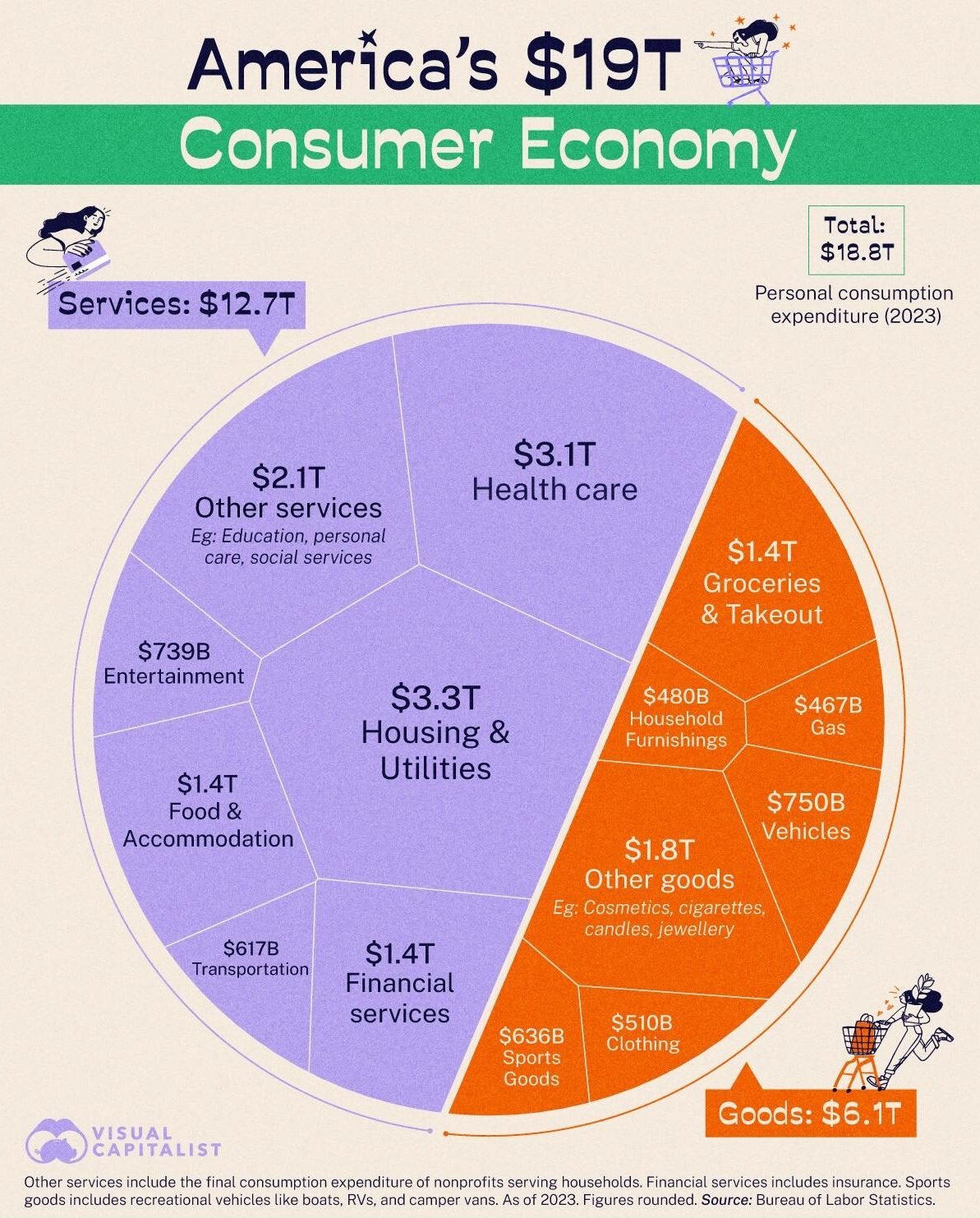

In 2023, American consumers spent nearly $19 trillion on goods and services, representing about 68% of the nation’s GDP. For perspective, that figure surpasses China’s total GDP of $17.8 trillion for the same year.

The largest categories of household spending included housing and utilities at $3.3 trillion and health care at $3.1 trillion. In terms of goods, groceries topped the list with expenditures reaching $1.4 trillion.

To help make sense of these vast numbers, we’ve also broken down household spending by year and month. It’s worth noting that figures can vary, as insurance costs may be included in broader categories like housing or transportation.

Additionally, a graphic from eight years ago offers insights into how spending trends have shifted since the 1940s.

Although the data may be older, it reveals notable trends: health care and housing costs have risen, while spending on clothing and food has declined.

The Pros and Cons of the Service Economy

Significantly, services now account for nearly 70% of personal consumption expenditures in the U.S. This trend aligns with the job market, where approximately 80% of American jobs are in the service sector.

The shift from manufacturing to services—both in production and consumption—reflects a complex narrative.

While this transition has fueled the growth of high-value technology and financial sectors, it has also contributed to the decline of blue-collar jobs across the nation.

This discussion is particularly timely as we look to the future under the Trump administration’s second term.

Broad tariffs on imported goods aim to reduce trade deficits and encourage companies to bring manufacturing back to the U.S.

However, with modern manufacturing reliant on global supply chains and just-in-time shipping, economists express concern that such disruptions may lead to higher prices for American consumers.