In many European nations, housing costs are taking a bigger bite out of workers’ paychecks. As affordability issues rise, protests have erupted in cities like Madrid, Lisbon, and Berlin, highlighting the widening gap between wages and rent.

For example, in Hungary, home prices have skyrocketed by 234% from 2010 to 2024, significantly outpacing the EU average of 55.4%. This graphic, created by Visual Capitalist’s Dorothy Neufeld, illustrates the housing cost burden across European countries in 2024, using data from Eurostat.

Which Countries Face the Highest Housing Cost Burden?

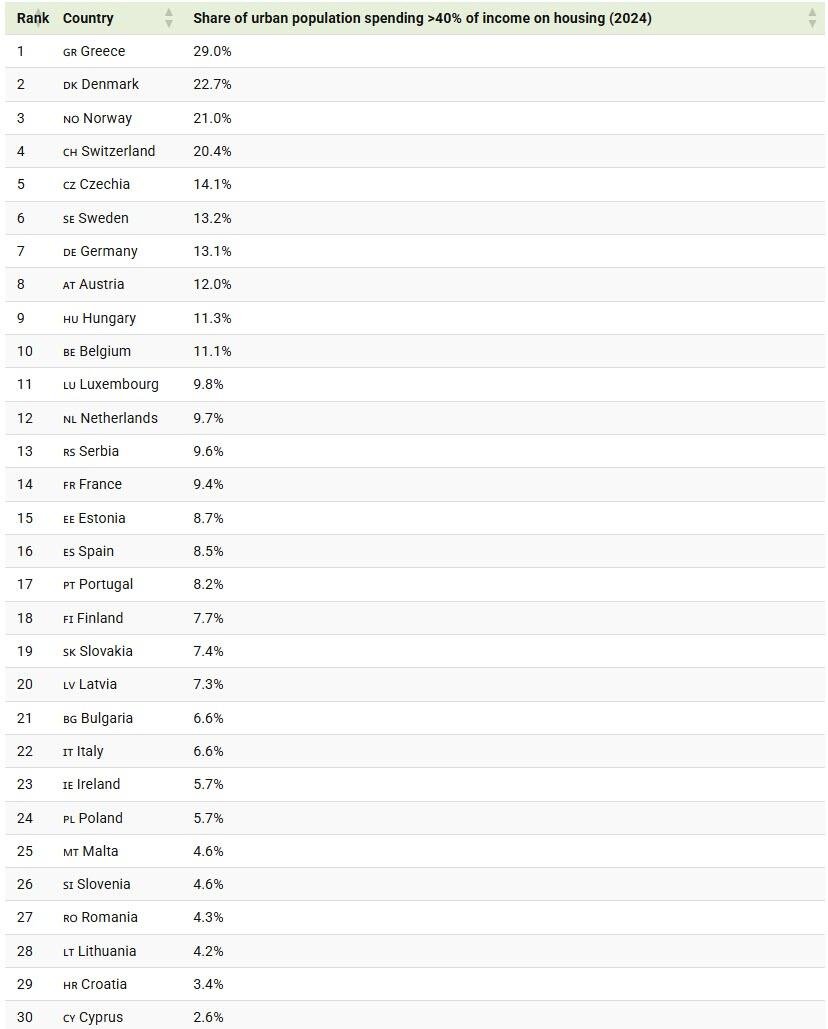

The table below ranks EU countries based on the percentage of the population spending over 40% of their household income—after taxes and pension contributions—on housing.

Note: Data for Switzerland is current as of 2023.

In Greece, where wages are among the lowest in the EU, nearly three times the average population is burdened by housing costs. The home price-to-income ratio reached a staggering 12.7 in 2024, the highest since 2007.

This trend is fueled by ongoing inflation and an influx of foreign buyers driving prices even higher.

Denmark follows closely, with 22.7% of its population overburdened. Since June 2024, the central bank has lowered interest rates eight times, increasing demand for housing. In Copenhagen, home prices have doubled over the past decade.

In contrast, Germany’s higher wages help mitigate the impact of rising living costs, with only 13.1% of residents facing housing costs that exceed 40% of their income. On average, wages in Germany are about 35% higher than the EU average.

Conversely, Croatia and Lithuania stand out as some of the most affordable countries, largely due to high home ownership rates that protect residents from volatile housing costs.