(Simply Wall St)

If you buy and hold a stock for many years, you’d hope to be making a profit. Furthermore, you’d generally like to see the share price rise faster than the market. Unfortunately for shareholders, while the Wells Fargo & Company (NYSE:WFC) share price is up 79% in the last five years, that’s less than the market return. Some buyers are laughing, though, with an increase of 56% in the last year.

Now it’s worth having a look at the company’s fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

To quote Buffett, ‘Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace…’ One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During five years of share price growth, Wells Fargo achieved compound earnings per share (EPS) growth of 6.5% per year. This EPS growth is lower than the 12% average annual increase in the share price. So it’s fair to assume the market has a higher opinion of the business than it did five years ago. And that’s hardly shocking given the track record of growth.

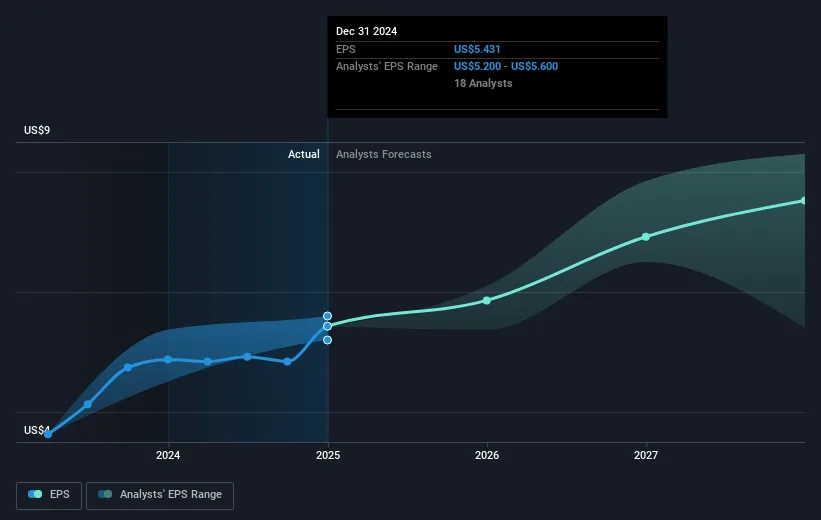

The company’s earnings per share (over time) is depicted in the image below.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, Wells Fargo’s TSR for the last 5 years was 103%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It’s good to see that Wells Fargo has rewarded shareholders with a total shareholder return of 60% in the last twelve months. And that does include the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 15% per year), it would seem that the stock’s performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper.

The Services and the Content are provided to you solely for your general informational purposes, and should not be considered as legal, tax, accounting, financial or investment advice.You are solely responsible for determining whether any investment is suitable for you, considering your investment objectives, risk tolerance and personal financial situation. It is also your responsibility to evaluate the merits and risks of using the information provided on this site before making any decisions.