By Charles Hugh Smith

Now that the entire economy depends on these hyper-normalized speculative bubbles for its “growth” and “wealth,” there is a profound fear of a future based not on artifice but on the real world.

Humans are quick to habituate to current conditions, i.e. consider them normal. This rapid normalization has advantages and disadvantages.

Normalization is an adaptive strategy, enabling humans to adapt readily to conditions that are considerably different from their previous “normal” state of affairs. So those ripped out of their “normal” lives and thrown into the Gulag soon consider the wretched conditions of the prison camp “normal.”

The downside of normalization is that it erects a defensive barrier between the real world and the perceived i.e. normalized world. In systems that have failed but are incapable of real reform, normalization phase-shifts into Hyper-normalization (generally one word, Hypernormalization), a peculiar adaptative state described by Alexei Yurchak, a Russian anthropologist who used the term in his 2005 book Everything was Forever, Until it was No More: The Last Soviet Generation.

Documentary filmmaker Adam Curtis described Hypernormalization in this way:

“’HyperNormalization’ is a word that was coined by a brilliant Russian historian who was writing about what it was like to live in the last years of the Soviet Union. What he said, which I thought was absolutely fascinating, was that in the 80s everyone from the top to the bottom of Soviet society knew that it wasn’t working, knew that it was corrupt, knew that the bosses were looting the system, know that the politicians had no alternative vision. And they knew that the bosses knew that they knew that. Everyone knew it was fake, but because no one had any alternative vision for a different kind of society, they just accepted this sense of total fakeness as normal. And this historian, Alexei Yurchak, coined the phrase ’HyperNormalisation’ to describe that feeling.”

I submit that the U.S. economy and stock market have been hypernormalized to the degree that what is now viewed as “normal” is completely detached from the real world. What we inhabit is a system that has lost all authenticity and survives entirely on the ceaseless marketing of artifice, a.k.a. narrative control that benefits the few at the expense of the many.

In effect, “normal life” is stripped of authenticity in favor of a simulacrum “normal” that supports those at the top of the status quo. This “new normal” reaches extremes of artifice, hence hyper-normalization.

As long as everyone thinks there are no alternatives to this hyper-normalized simulacrum, this artificial construct appears to be immutable–everything is forever.

But once the power structure admits, however minimally, that it no longer has the answers to the decay of the social-economic order, then the entire artificial construct collapses in a heap. This is the sociology of collapse: people accept a facade of artifice and propaganda without actually believing any of it, though they do have a limbic loyalty to the founding ideals of the nation.

What’s real is denial, repression of non-conforming realities, group-think, virtue-signaling and a profound loss of competence.

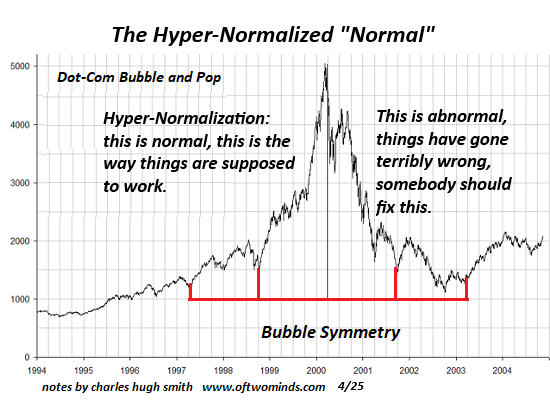

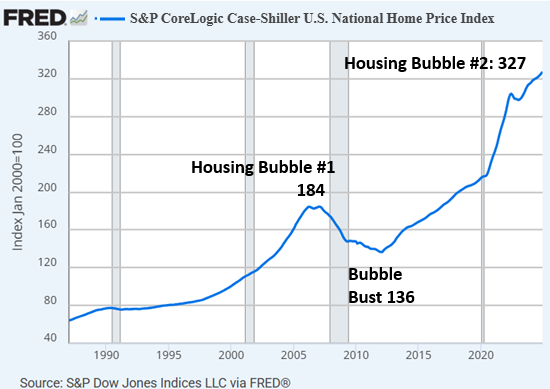

In this hyper-normalized state, madness of crowds speculative bubbles are now considered normal, not just in stocks but in housing, commodities, quatloos and everything else that can be commoditized, marketed and sold:

So Housing Bubble #2 is not viewed as an insane extreme that is bound to succumb to gravity, it’s “normal.”

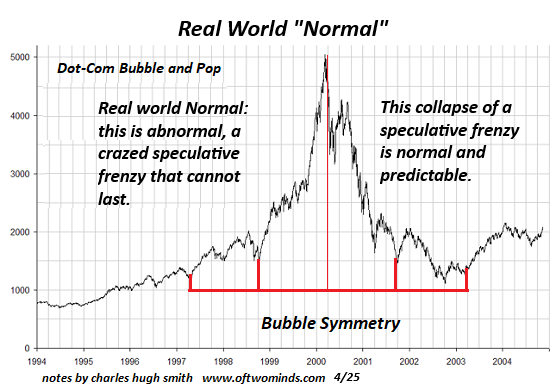

Here is the real world: speculative frenzies are abnormal and the collapse of these bubbles is normal and predictable.

Now that the entire economy depends on these hyper-normalized speculative bubbles for its “growth” and “wealth” (two additional examples of hypernormalization), there is a profound fear of a future based not on artifice but on the real world.

The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of Censational Market.