Staff reporter

Brookfield Asset Management (BAM), a large Canadian asset manager, recently announced a massive 15% increase in its dividend. The company is optimistic that this trend will continue over the next decade, which has important implications for existing investors. Here’s what you need to know.

What does Brookfield Asset Management do?

As an asset management company, Brookfield takes money from clients and invests it in a variety of sectors. Although the company has historically focused on infrastructure, it has recently expanded into areas such as credit investments.

The firm focuses on alternative assets, ranging from collectibles to timberland, an area of growing demand. As of the first quarter of 2025, Brookfield manages approximately $550 billion of fee-based capital across renewable energy, infrastructure, private equity, real estate and credit investments.

The key takeaway? Brookfield Asset Management manages a large amount of assets and uses five different investment strategies to drive growth. The company aims to double its fee-based capital to more than $1.1 trillion by 2029 and believes that will support dividend increases of 15% per year over the next decade. Currently, the dividend yields about 3.1%.

Dividend Yield as a Valuation Tool

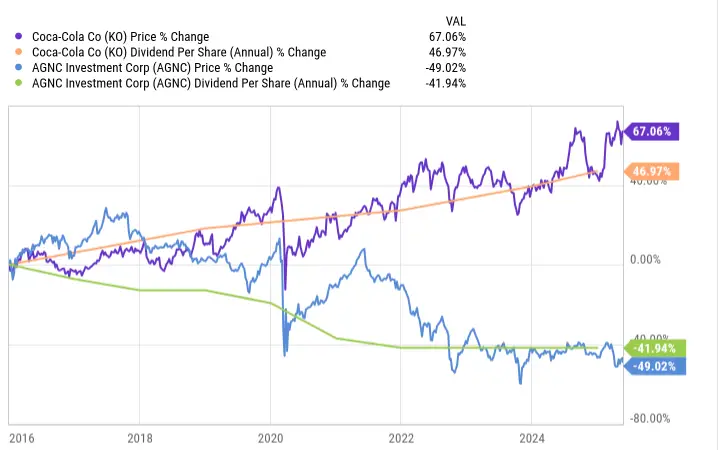

Investors often view dividend yield as a measure of a stock’s potential earnings. That view is certainly valid, but dividends are also a stable valuation tool. Historically, stock prices tend to trend in line with dividends; rising dividends generally lead to higher stock prices.

For example, consider the stocks of Coca-Cola (KO) and AGNC Investment (AGNC), which illustrate how dividends can affect market perception.

If Brookfield meets its dividend growth forecast, the current quarterly dividend of $0.4375 could increase to around $0.88 per share by 2030, essentially doubling.

If the stock price remains constant, the yield will be 6.2%. Conversely, if the stock price rises to maintain a 3.1% yield, it will need to rise from about $56 to about $112, which is equivalent to a doubling of the stock price.

What investors think of Brookfield Asset Management

Today, investors’ evaluation of Brookfield reflects three key points:

- Since the S&P 500 yields just 1.3%, Brookfield stands out as a high-yield stock.

- If the company achieves its growth targets, it could also be a strong growth stock.

- If the dividend increases as expected, Brookfield will become a compelling dividend growth stock.

These factors make Brookfield Asset Management a good choice for many investors.

Looking Ahead: Brookfield Asset Management Over the Next Five Years

If Brookfield succeeds in growing its fee-paying capital, it could double in size within five years, with a corresponding increase in dividends. Historically, dividend stocks have risen in value, meaning Brookfield’s stock price could rise significantly.

While dividend investors will need to keep a close eye on Brookfield’s performance, the outlook is bright if the company hits its targets.

The Services and Content are provided for your general information only and should not be construed as legal, tax, accounting, financial or investment advice. You are solely responsible for determining whether any investment is appropriate for you based on your investment objectives, risk tolerance and personal financial situation. You are also responsible for evaluating the pros and cons of using the information on this website before making any decision.