Harsh Chauhan

Nvidia (NVDA) is one of the biggest names in the artificial intelligence (AI) semiconductor space. It is the dominant player in the market for data center graphics cards, and the good news for prospective investors is the stock has been under pressure in 2025.

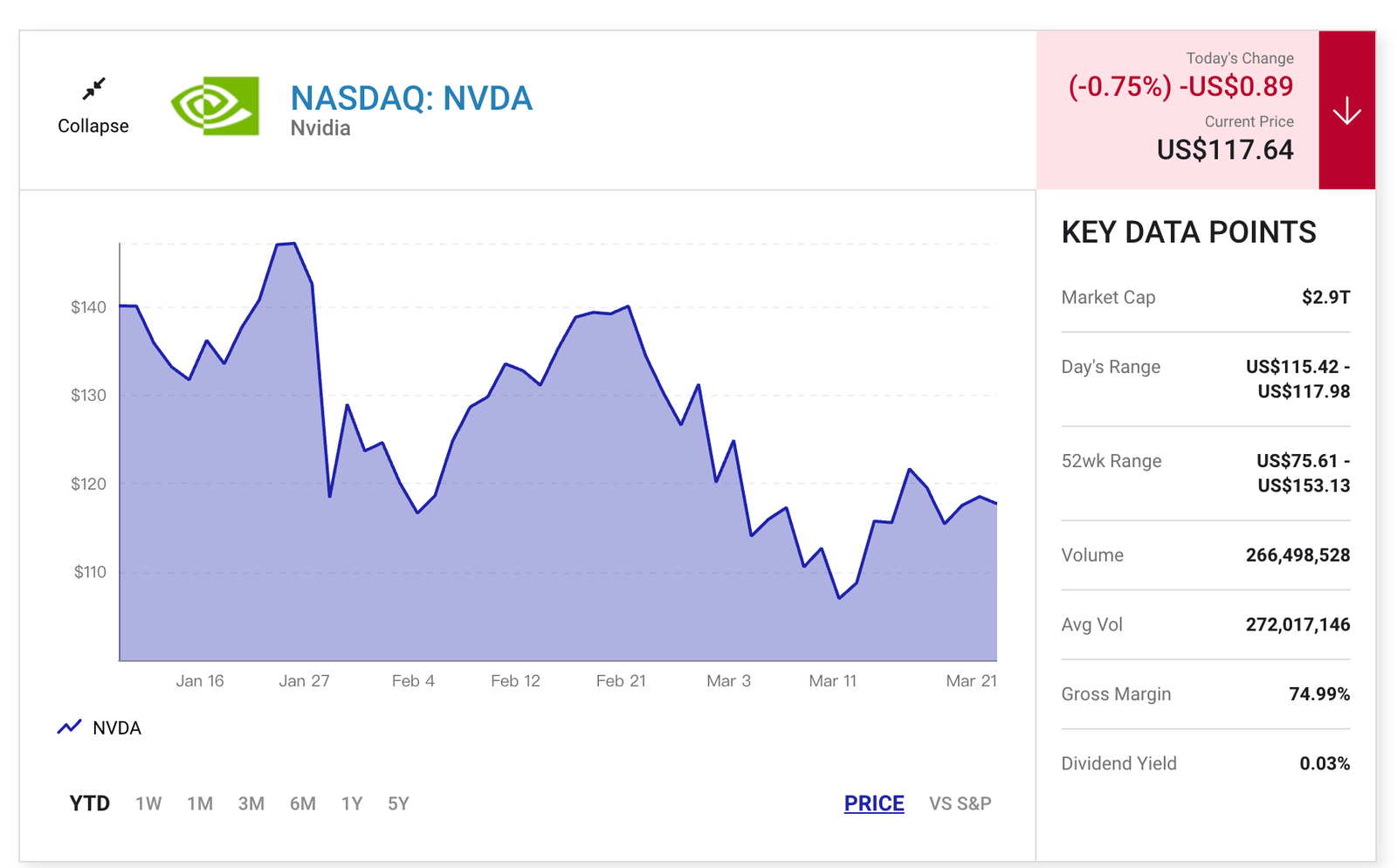

Nvidia has lost 12% of its value year to date despite delivering solid fiscal 2025 results in late February, including guidance that suggests its impressive growth is here to stay. Let’s take a look at the reasons why Nvidia could bounce back and clock healthy gains in the next year.

Nvidia’s control over the AI chip supply chain should translate into more growth

Cloud computing giants and governments across the globe rely on Nvidia’s graphics processing units (GPUs) for AI model training and inference. The company’s dominance in the data center GPU market is so strong it has left very little business for rivals such as Intel and AMD.

This is evident from the $115.2 billion in data center revenue it generated in fiscal 2025 (ended Jan. 26). Meanwhile, AMD sold $12.6 billion of data center chips in 2024, and Intel’s data center and AI segment reported $12.8 billion of revenue last year.

With such a big lead over its rivals, Nvidia has also been able to claim a significant chunk of the industry supply chain. According to Taiwan-based Economic Daily News, Nvidia has cornered 70% of Taiwan Semiconductor Manufacturing‘s advanced chip packaging capacity for this year.

Given that TSMC’s chip capacity is expected to more than double in 2025, followed by another increase of 80% in 2026, Nvidia should be able to churn out enough AI chips to meet the terrific demand for its latest generation of Blackwell AI GPUs.

Third-party checks indicate the demand for Blackwell chips is exceeding supply, so an improved supply chain will help the company fulfill orders and deliver stronger growth in the coming quarters.

Not surprisingly, there was a bump in analysts’ growth expectations for Nvidia in the current year after it released its fiscal 2025 results.

The consensus estimates above imply at least 50% revenue and earnings growth in fiscal 2026. However, Nvidia says its gross margin will start heading higher once it completes the production ramp-up of its Blackwell processors.

The company is currently prioritizing output to meet demand, and during the latest earnings call, CFO Colette Kress noted Nvidia will “have many opportunities to improve the cost” once production is in full swing. As a result, gross margin should jump from the low-70% range in the earlier part of the fiscal year to the mid-70% range in the latter part.

Analysts are expecting a nice jump in the coming year

Of the 67 analysts covering Nvidia, 93% have rated it a buy. What’s more, its 12-month median price target of $175 is 52% higher than where the stock trades as of this writing.

Nvidia could indeed approach that price target if profitability improves as the year progresses. The stock’s forward price-to-earnings multiple of 26 is also near its lowest point in the past year.

The Services and the Content are provided to you solely for your general informational purposes, and should not be considered as legal, tax, accounting, financial or investment advice.You are solely responsible for determining whether any investment is suitable for you, considering your investment objectives, risk tolerance and personal financial situation. It is also your responsibility to evaluate the merits and risks of using the information provided on this site before making any decisions.